Integer Advisors is an independent research-led advisory firm. The company is owned entirely by its employees, unconflicted therefore by not having any external stakeholder interests.

Our expertise lies in European alternative asset finance and its related capital market constituencies. We deliver this niche expertise to our clients via in-depth research and bespoke advisory services.

Private and Alternative Credit Markets – Our Niche Expertise

We specialise specifically in investable loan markets within Europe. By ‘investable’ we mean the more liquid asset finance sectors with capital market footprints, mobilised outside of traditional bank balance sheets. Such assets are typically dominated by alternative loan types. Integer Advisors coverage includes residential mortgages, consumer credit, student loans, small/ mid-cap corporate loans and receivables as well as selected leveraged loans and infrastructure-like assets. We believe the presence of such alternative, non-bank lender-dominated asset types will increase as the credit system in Europe matures, fuelled not least by bank portfolio divestments.

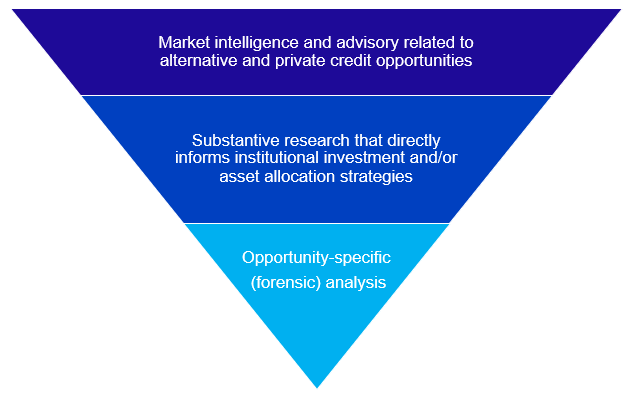

Thought Leadership in Alternative Credit Opportunities

Alternative loan types normally manifest in the capital markets via securitized products, which in turn commands the bulk of our analysis and research focus. Aside from ABS, RMBS, CLOs, etc., we also selectively cover any other bond, equity and/ or whole loan products that present asset finance-related opportunities to institutional investors. In other words, the research and advisory aspirations at Integer Advisors are primarily asset-driven while being liabilities-agnostic.

Demystifying the Alternative Lenders and Buyers

Integer Advisors’ lens into the private credit universe gives us an unparalleled insight into the non-bank lender market in Europe, a rapidly growing sector fuelled by the forces of bank disintermediation in recent years. Such debt lenders range from specialist fincos to marketplace lenders to direct loan funds, among the many other types. Mirroring this recent proliferation of specialist, non-bank lenders is the growth of investment funds dedicated to asset finance opportunities in Europe, across senior debt, mezzanine and equity special situations. We provide our clients with unique intelligence on these intermediary models within the European asset finance market.

Pioneering Best-in-Class Research & Advisory Services to Institutional Clients

Our research into asset finance and its capital market constituents is based on in-depth and rigorous analysis of both fundamentals and technicals, spanning from macro thematic trends to portfolio- or lender-specific credit forensics. What further differentiates Integer Advisors is our intensively data-driven research style, which includes the application of relevant Big Data concepts to predictive credit modelling and investment ideas in asset finance, based on isolating high-value data from the ‘noise’ that is often otherwise inherent in Big Data. Above all, our business remains singularly focussed on our clients.