Generally adaptable, but CLOs and NPLs face fresh burdens

ESMA recently published its final report on the technical standards on disclosure requirements for securitisations in Europe. Looking through what is a highly technical 339-page document reveals a number of important consequences for the securitisation markets in Europe going forward.

To recap, many existing securitisations in Europe have had reporting and disclosure requirements for more than five years, but these requirements were enforced via the central banks (ECB/ BoE) under their respective repo criteria. Its scope was therefore limited to securitisation types that are eligible for repo in the first place. What has now changed is that disclosure and reporting requirements will become a blanket obligation for all EU securitisations, enforced directly through issuer requirements as well as mirroring investor due diligence obligations. As we discuss below, this EU-based regulatory regime may also ultimately have an extra-territorial impact on cross-border securitisation deal flow sold into Europe. In this commentary, we focus on the changes under the new rules (rather than existing framework), starting with our summarised thoughts.

Assuming that the final report will be adopted into legislation, investors will see a significant increase in information flow in some segments of the market which, in conjunction with the more formalised due diligence requirements, will lead to additional resource needs on the investor side, in our view. There are still some unresolved issues, as outlined in the sections below, particularly with respect to the potential phase-in period which ESMA is referring back to the European Commission.

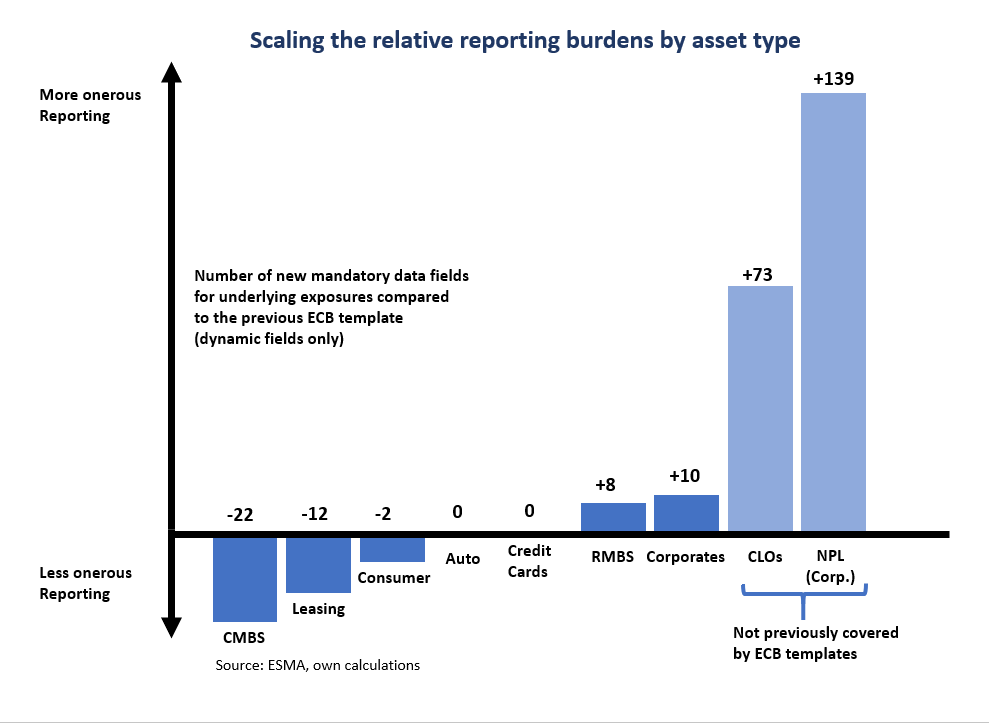

In summary, given the recent history of loan-level reporting requirements, we do not see the new regulation and data templates as being materially disruptive for most asset classes, operational adjustments notwithstanding. Notable exceptions are CLOs and NPL securitisations, where the changes are by contrast more substantive and will inevitably require significant investment in reporting capabilities. The new regulations will also be also more burdensome for EU investors, reflecting the increased scope of formal disclosures and due diligence requirements. All that said, we see potentially positive effects in the longer-term from the better market transparency and standardisation that should come with these new regulatory requirements, ultimately improving investors’ ability to monitor and predict credit performance. But we are equally cognisant that transparency, while in itself a necessary ingredient for effective markets, is not a cure-all for securitisation performance risks as was clearly evidenced by the previous US subprime mortgage crisis.

While many aspects in the final report are positive and an improvement relative to the consultation paper, we see in particular some challenges for CLOs, CMBS and NPL securitisations. In a nutshell:

Positive outcomes:

- Timing: ESMA has published the report significantly ahead of the deadline, hence allowing the European Commission to adopt this Level-2 regulation before January 1st 2019. This would allow issuers/originators to directly use the new disclosure regime rather than having to use the transition measures, which would mean adjusting securitisation reporting twice. In our view this burden would be a deterrent to new ABS issuance in (early) 2019

- Removal of certain data fields: We had previously argued (see our Pulse from 22 February 2018) that loan-level disclosure of PDs and LGDs would be challenging for a number of reasons. These have now been removed, as have some other more problematic data fields. The templates are now more easily usable, particularly for non-banks

- Many technical points have been pragmatically resolved.

Challenges remaining:

- Leveraged loan CLOs will be required to use the corporate template with some additional data fields as well as a separate section on the CLO manager and transaction details. It remains to be seen how the CLO market will cope with the additional reporting obligations, particularly given that 1) no previous operating or management experience exists given that CLOs were not part of the ECB/BoE collateral reporting requirements, and 2) some of the data fields disclose information on underlying obligors (typically loan borrowers in private markets) which have not been reported in the past

- For CMBS, data templates continue to be among the most extensive, the only let-up being that tenant information is now restricted to the 3 largest tenants

- NPL (or ‘NPE’, as referred by the regulators) securitisations have to report loan-level data using the respective asset class templates plus additional NPE fields based on the EBA NPL template – not unexpected (and in our view, justified). But there is still a high level of data disclosure which will be challenging for some portfolio sellers, whether banks or secondary portfolio owners. The public nature of such disclosure may also prove to be a deterrent to continued bank NPL deleveraging through public securitisations

- One surprising feature is that the NPE data sections also apply for securitisations where the NPE portion has increased above 50% of current pool balance. We see this as a potential challenge for tail periods of “normal” securitisations where more senior notes have been largely redeemed but the clean-up call is not yet exercised, leaving a typically higher portion of NPEs in the pool balance. This requirement could therefore mean a significant increase in reporting obligations for some deals towards the end of their economic life.

The split of the investor reporting into (ongoing) investor reports, “significant event” reports and “inside information” reports makes the reporting, in principle, clearer and more defined, notwithstanding the greater administrative burden on issuers. However, we note that the “significant event” report (which is relevant only for public securitisations) has a number of data fields which patently require ongoing inputs, such as fields relating to master trusts and issued notes – this particular report is thus effectively a separate ongoing reporting obligation, which of course is hardly ideal.

With respect to the jurisdictional scope, it remains unclear if EU regulated investors have to receive the same information also for non-EU securitisations, in line with Article 7 (in cases where originator, sponsor and SSPE are not based in the EU). The due diligence obligation in Article 5 includes a reference that investors must validate that adequate information is provided by in accordance with Article 7, but the wording “where applicable” is unclear in that context and if limits the obligation to EU-securitisations only. In our view, the spirit of the new regulations essentially mirrors issuer reporting requirements and investor due diligence obligations of the same, meaning that any EU regulated investor buying non-EU securitised products would likely need to be provided substantially similar data and information in order to be compliant with the regulations. This would of course be particularly relevant for global, cross-border markets such as leveraged loan CLOs.

Importantly, the reporting obligations on the underlying exposures and investor reports are also applicable for private securitised transactions but will not be published through the securitisation repositories, ultimately confirming our earlier understanding from the Level-1 text (ESMA i.e. considers a potentially different approach as outside of its mandate). In effect therefore, private deals will remain private in terms of information/ data disclosure, but the scope of reporting remains largely the same as public securitisations.

No significant changes for RMBS, SME and consumer related asset classes after all

We argued in the past that the disclosure of PD/LGD metrics on an exposure level would have been disruptive, not least given the possibility to reverse-engineer credit models. In addition– in the case of corporate securitisations – this could have led to the disclosure of bank internal ratings and other information for some obligors, a potentially highly problematic outcome from a legal and regulatory perspective (see our Pulse from 22 February 2018). We hence welcome the removal of these PD/LGD data fields as well as the specific obligor names for larger corporates in the corporate template. PD frequency distributions have to be now provided at pool level, which we think would be more acceptable for (bank) issuers.

These changes are also welcome from the perspective of non-bank originators, an issuer constituency that does not naturally operate around PD/LGD data. There are still some bank-driven data fields such as credit-impaired obligor and default definitions but we think that the remaining challenges are now more limited for non-banks in this regard.

We note that the actual templates have changed in terms of format but the content is very similar to what has been the norm over the last few years based on the ECB/BoE reporting. On balance, these asset classes should have relatively limited remaining challenges although the technical implementation of the new templates will still like be a major administrative task for many originators.

Leveraged loan CLOs will be most affected

We see the CLO market as being most affected by the changes, an important observation considering what is the most dominant securitised sector currently if measured by deal flow. Hitherto, there have been no formalised loan level reporting templates for CLOs given their ineligibility within the collateral framework of the ECB and BoE. The new requirements will hence force many CLO managers into investing in new reporting capabilities for their active CLO programmes in 2019 and beyond. As mentioned above, non-EU CLO issuers (US managers namely) will likely – in our view – need to provide substantially the same data and information in order to tap the regulated EU investor base, which remains subject to due diligence compliance obligations. It will be interesting to see if this ‘back-door’ regulatory capture of non-EU securitisations (via EU investor obligations) will ultimately reach into global CLO market practices in terms of reporting requirements.

ESMA decided against customising the corporate templates just for CLOs, opting instead to maintain the standard corporate template but adding CLO specific data fields such as market value and put options metrics. More importantly, in our view, is the obligation to disclose specific balance sheet data on the underlying obligors, to include revenue, total debt, EBITDA or Enterprise Value, etc. How and whether such name-specific disclosure requirements can be reconciled with what is essentially a private loan market remains to be seen. While technically the names of obligors do not need to be disclosed, in practice it should be relatively easy to identify the underlying loan borrowers (if not otherwise published in the investor report). ESMA explicitly refutes the argument that the information might be only available to the original lender and effectively obliges the CLO manager to provide such information. On top of the underlying exposure disclosure, there are specific CLO transaction and manager sections in the investor “significant event” disclosure template.

CMBS template lighter but still extensive

The revised CMBS template retains tenant specific information but is now limited to the 3 largest tenants. On the CMBS side we do not see any major changes as most transactions already publish tenant information on the largest tenants, that aside tenant rating data fields have now been removed. Nevertheless, there might be confidentiality issues for some CMBS going forward. We note however that the template continues to be substantially similar to the E-IRP template published by CREFC as an industry body. The old ECB CMBS template was also very similar although very few CMBS published loan level data on the European Datawarehouse as the designated ECB data repository.

Suggested phase-in period seems reasonable – but ESMA did not budge on unavailable or confidential data

ESMA outlined a suggested phase-in period of 15-18 months based on the ECB experience with its earlier loan-level initiative. However, in the final report there is no specific mention how this phase-in period will be handled and what thresholds will be used for the unavailability of data in the phase-in period. In this regard, ESMA states that transitional arrangements are outside of its mandate and refers the issue to the European Commission. It is therefore unclear to us if and how such a phase-in period will materialise.

On the so-called “No-data” options, ESMA maintains the view that existing options are sufficient in scope and specifically states that these options cannot be used to avoid reporting obligations. We feel this is a significant position to take in the sense that EMSA is explicit that the confidentiality defence outlined in Article 7(1) cannot be used to avoid reporting on the underlying exposures – in effect, ESMA sees the data fields as providing enough anonymisation. ESMA has now also defined for each data field whether a no-data option can be used. It remains to be seen how this will play out in practice given that it is next to impossible to systematically police the use of no-data options except in obvious cases of avoidance. Moreover, given the absence of thresholds, it is unclear to us what happens if there is an extensive use of no-data options as there is no (detailed) sanctioning mechanism as such envisaged at this stage, at least in our understanding.

Other noteworthy technical points

Without going in too much further detail, we see issues such as unique identifiers, ISO20022 and XML, cut-off dates and some definition issues as mostly positively resolved. Also, the introduction of a ‘default’ template for ‘esoteric’ transactions which do not fit other templates makes a lot of sense, in our view.

One negative however is the use of the currency codes in numeric (monetary) fields – in practice a very user-unfriendly change which requires splitting the data for any calculations. (We hope this decision can still be reversed). We also wonder why ESMA wants to maintain the split into static and dynamic fields but removed the distinction in the actual data templates.

Please contact us for our more detailed thoughts on due diligence obligations for investors under the new regulatory regime.

Disclaimer:

The information in this report is directed only at, and made available only to, persons who are deemed eligible counterparties, and/or professional or qualified institutional investors as defined by financial regulators including the Financial Conduct Authority. The material herein is not intended or suitable for retail clients. The information and opinions contained in this report is to be used solely for informational purposes only, and should not be regarded as an offer, or a solicitation of an offer to buy or sell a security, financial instrument or service discussed herein. Integer Advisors LLP provides regulated investment advice and arranges or brings about deals in investments and makes arrangements with a view to transactions in investments and as such is authorised by the Financial Conduct Authority (the FCA) to carry out regulated activity under the Financial Services and Markets Act 2000 (FSMA) as set out in in the Financial Services and Markets Act 2000 (Regulated Activities Order) 2001 (RAO). This report is not intended to be nor should the contents be construed as a financial promotion giving rise to an inducement to engage in investment activity.Integer Advisors are not acting as a fiduciary or an adviser and neither we nor any of our data providers or affiliates make any warranties, expressed or implied, as to the accuracy, adequacy, quality or fitness of the information or data for a particular purpose or use. Past performance is not a guide to future performance or returns and no representation or warranty, express or implied, is made regarding future performance or the value of any investments. All recipients of this report agree to never hold Integer Advisors responsible or liable for damages or otherwise arising from any decisions made whatsoever based on information or views available, inferred or expressed in this report. Please see also our Legal Notice, Terms of Use and Privacy Policy on www.integer-advisors.com