Putting Frontier BTL Markets in Perspective

11 October 2018

![]() Emerging BTL markets – IE and NL (PDF version)

Emerging BTL markets – IE and NL (PDF version)

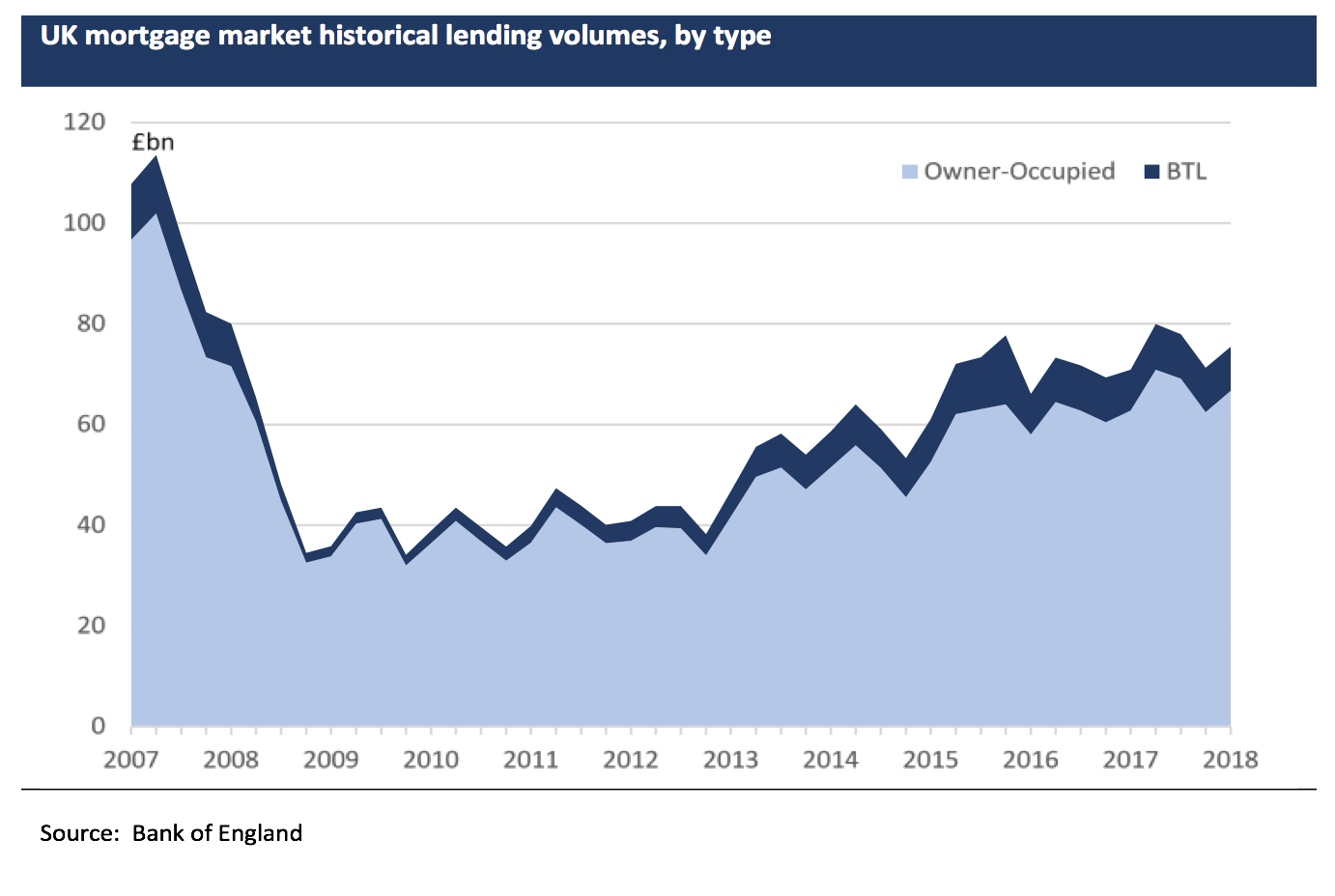

The buy-to-let mortgage capital markets in Europe have hitherto been dominated by opportunities in UK assets for the most part, with such risk dominating BTL RMBS markets and seen also more recently in listed bond and equity (whole loan fund) markets. To be sure, the 20+ year history of UK buy-to-let lending has fuelled a deep market for institutional lending and investment, led by specialist lenders on the one hand and private equity owners and mainstream capital market investors on the other. Front-book opportunities have been complemented by sizable legacy asset sales in the post-crisis era, such portfolios being orphaned by failed lenders.

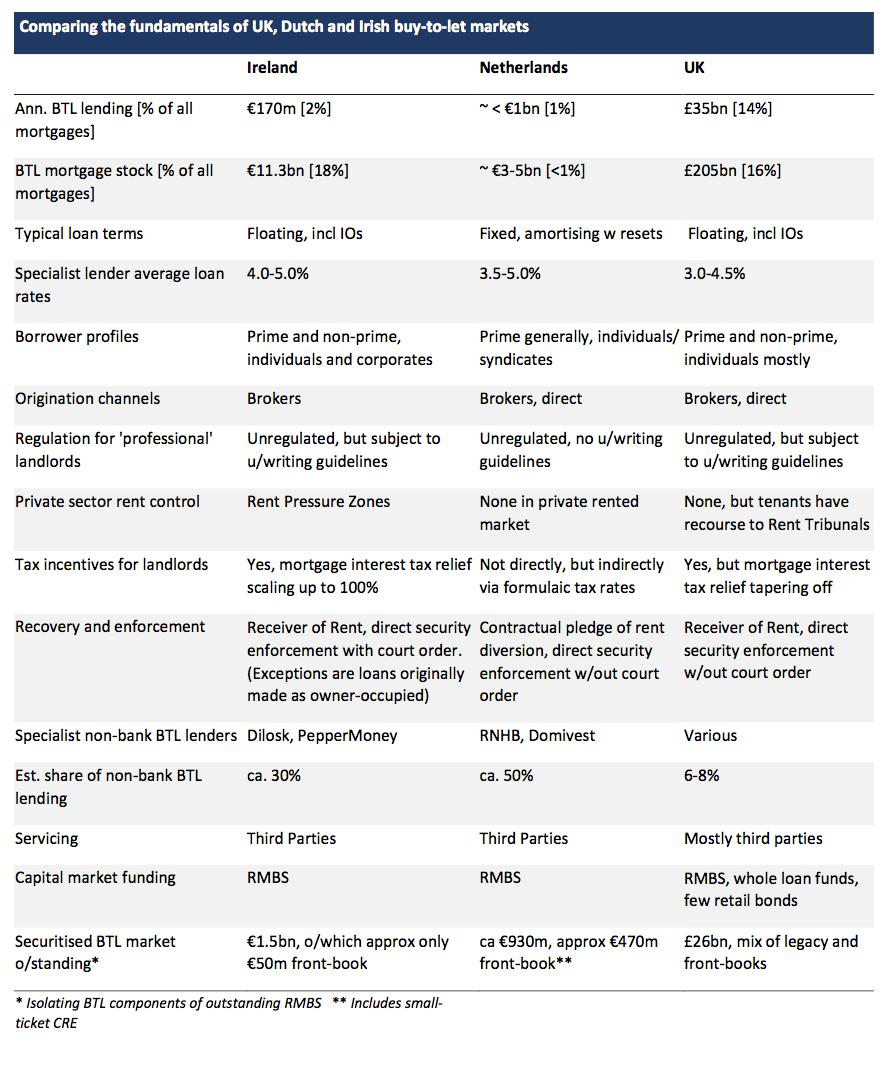

This commentary highlights two emerging buy-to-let markets in Europe that we identify as sharing broadly similar characteristics as the UK BTL market nearer the time of its inception, which in turn underpins their growth potential as investable markets over the foreseeable future. The two jurisdictions are Ireland and the Netherlands.

Genesis of the ‘buy-to-let’ product in selected mortgage markets

At this juncture we think it worthwhile to recap on what distinguishes a market defined as “buy-to-let” from vanilla investment mortgage lending that is well established in advanced mortgage economies such as the US, Germany and Australia, among others. We would highlight the following defining characteristics, covering the supply- and demand-side of the product class:

- Foremost is the shift in mortgage lending practices to define buy-to-let as a separate asset type. These shifts have been driven by the desire to more closely align BTLs to owner-occupied mortgages, and away from small ticket CRE loans (this happened in the UK), or conversely, the desire to provide loans that are underwritten to the real estate assets (often outside of the regulatory net) rather than borrower income affordability. In either case the primary driver for such reclassifications seem to have been competitive forces in mortgage lending markets

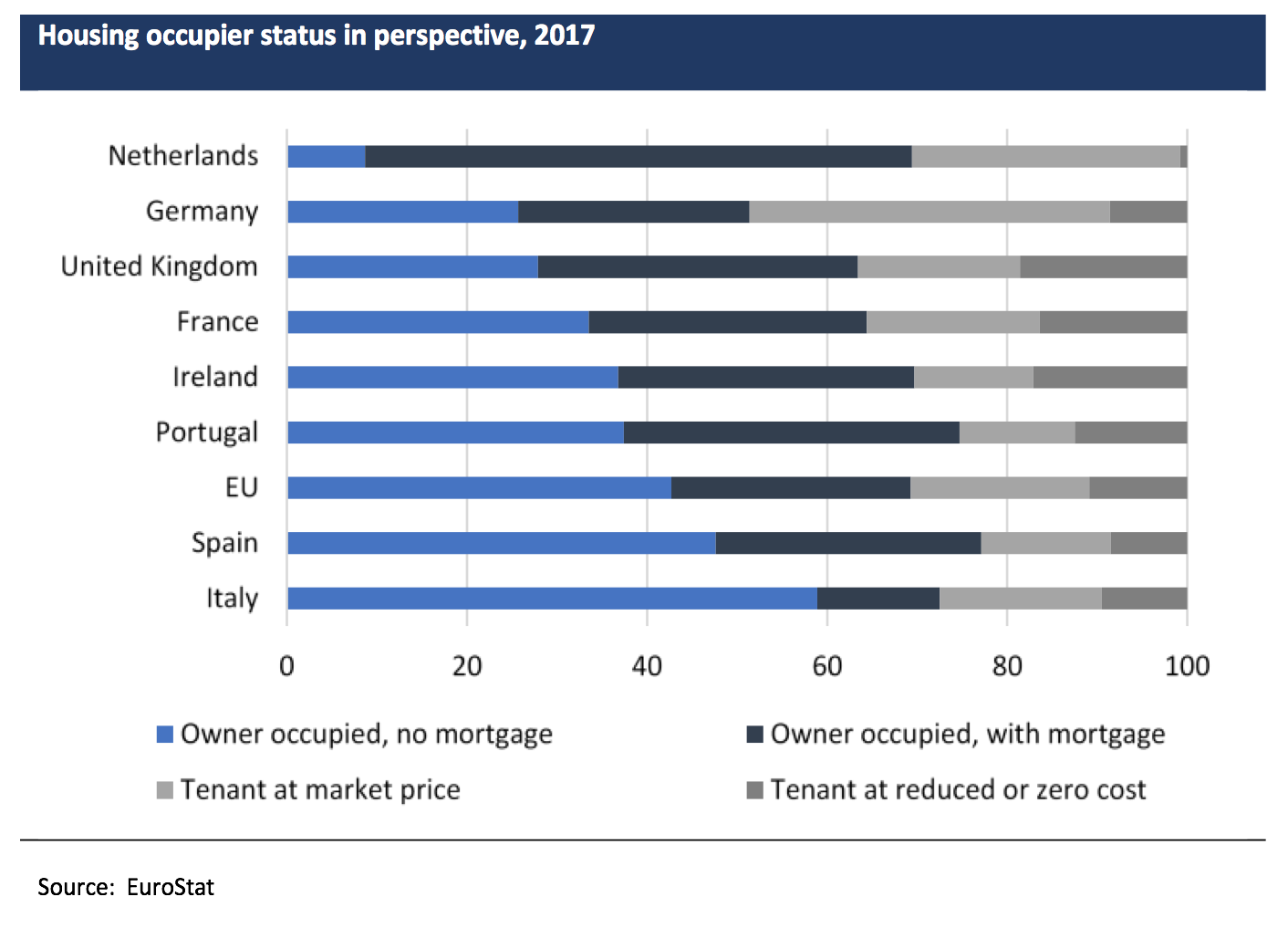

- On the demand side, BTL markets exists in economies where, fundamentally speaking, housing has come to be seen as an investable asset class, in effect a savings outlet for the wealth-owning segments of the household economy. Stable above-market yields in what has otherwise been a very low-rate environment, the ‘safe-haven’ perception associated with real estate, readily available mortgage leverage and – commonly – tax incentives have been among the key investment motivations in residential property

- On the supply side, BTL volumes have historically been fuelled by lending appetite – among banks and non-bank lenders alike – for higher yielding loans relative to owner-occupied mortgages but typically without the commensurate loss risks associated with other non-prime products with yield premiums. More punitive capital and tighter prudential regulatory frameworks for BTLs over the post-crisis era have led to a lending retreat by banks, with this capacity largely filled by specialist lenders targeting the unregulated BTL segment (that is, “professional” landlords, defined varyingly). Institutional investment appetite across debt (whole loan or securitised) and equity (ownership stakes in fincos) has cemented the viability of non-bank models in the BTL markets

Ireland and Netherlands can be broadly characterised by the market dynamics/ shifts described above. Both mortgage markets have witnessed a defined BTL product suite emerge in recent years, though the histories of the two housing economies are starkly different. Ireland has come out of an unprecedented housing recession which took a heavy toll on legacy BTL assets, with the “BTL 2.0” renaissance still near its infancy amid the overhang of the pre-crisis market. The Dutch BTL market, by contrast, is more of a debutante given no meaningful precedence as a defined mortgage product type.

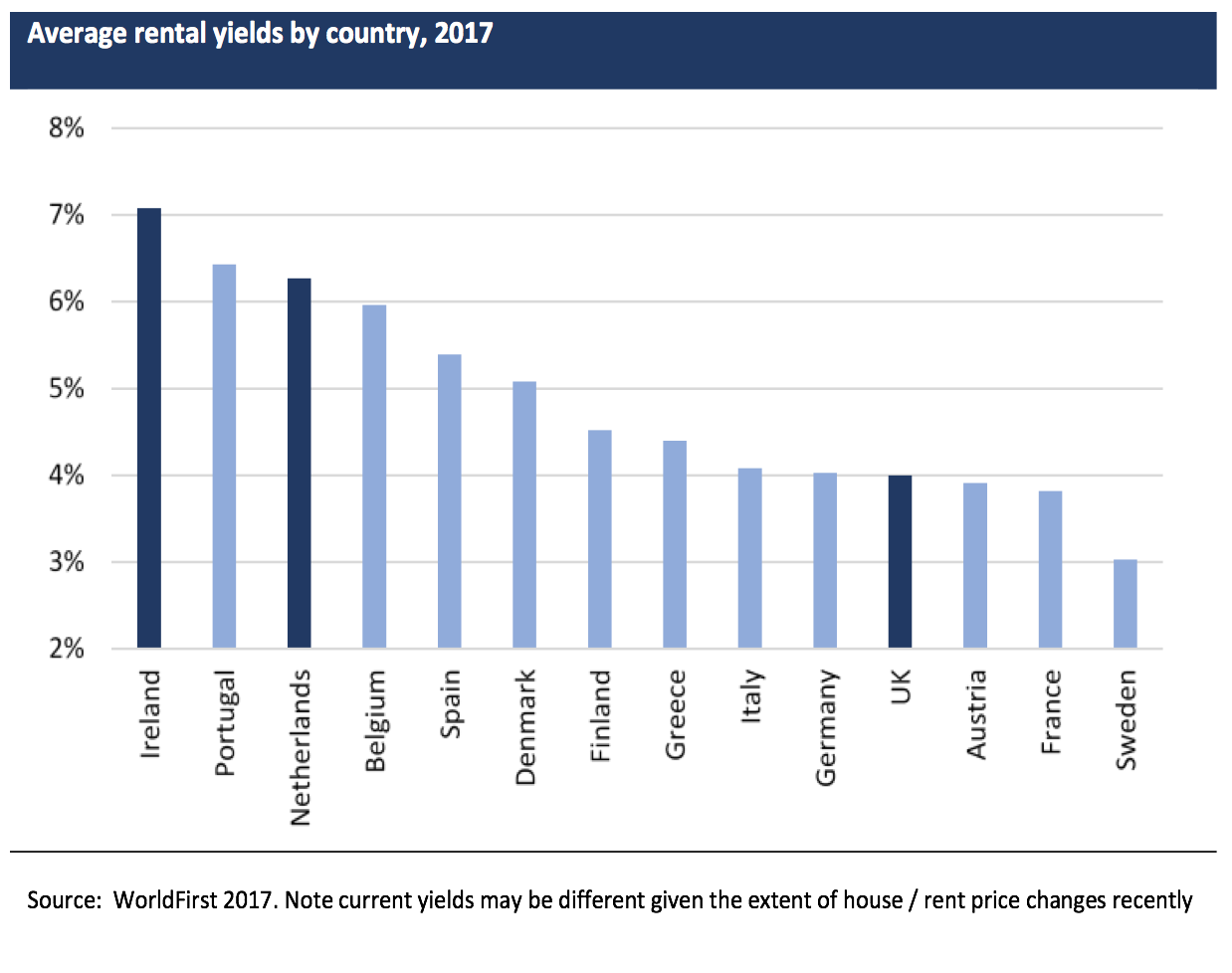

Compelling residential property investment economics and better financing availability fuel BTL ‘2.0’ market growth

Not coincidentally, both Ireland and the Netherlands stand out for having among the highest residential rental yields in Europe, underpinning the BTL investment rationale. Both these economies are characterised by a shortage of housing, coupled with recent strengthening in rental demand due to a number of factors that have served ultimately to favour renting over owning, to include tax changes, tighter macroprudential rules for owner-occupied mortgage lending as well as first-time buyer affordability constraints that reflect higher house prices. Favourable tax treatment of residential property investments has also fuelled the BTL appetite in both countries.

Both Ireland and the Netherlands remain at the very early stages of buy-to-let mortgage market growth, driven on the financing side by the emergence of non-bank fincos as alternative lenders to the few banks still lending in this space. The non-bank lender constituency in both countries remains very young and sparsely populated, in distinct contrast of course to the more established and mature UK specialist lender base. But like their UK peers, specialist lender models in both Ireland and Netherlands exploit their competitive advantages of operating in ‘alternative’ lending segments, which in both countries are characterised by lending that requires more complex / non-standard underwriting, rather than adverse credit per se. Banks in Ireland and the Netherlands tend to have narrower lending perimeters and less flexible underwriting criteria, similar in that sense to mainstream banks in the UK, and distinguishable from banking peers in the likes of Germany or France.

Contemporary Irish and Dutch BTL loan profiles typically resemble their respective owner-occupied mortgage products, but with lending generally undertaken outside of the regulatory boundaries. Given the infancy of the BTL 2.0 markets, the investment properties backing such loans are still disproportionately concentrated in cities/ urban areas where supply shortages and demand clustering (or agglomeration, in economic speak) create the most favourable rental economics.

Ownership of post-crisis specialist lenders in both markets is typically anchored by private equity and/or alternative investors. (Such alternative money is arguably a spill-over from the maturing opportunity set in the UK). Debt financing has been provided by bank facilities or institutional forward purchase agreements in a few cases, with only a couple of front-book lenders tapping the securitisation capital markets thus far.

From unlisted equity stakes to capital market instruments – scoping the investment opportunities to come

Securitisation remains the go-to capital market funding channel for the few BTL lenders in Europe, with a long-established market history carved out by UK banks and non-banks over the past 15 years. In the case of Irish and Dutch BTLs, the RMBS capital market has played host to a number of post-crisis transactions, but such securitised portfolios have been dominated by legacy or back-book assets, with loans typically aged 10-12 years. The front-book components of securitisations have been fractional in the case of Ireland, and up to ca. 30% in the case of the Netherlands, though we would caution that this ratio overstates the BTL element given the typical mix of securitised assets including small-ticket CRE loans.

We expect front books to dominate RMBS deal flow going forward as BTL lending matures further in both markets. In the particular case of the Netherlands, we anticipate seeing a greater variety of capital market opportunities ultimately – to potentially include whole loan funds and perhaps mortgage bonds (blending covered bonds with pass thru technology, similar to Denmark) – which would mirror the diversified institutionalisation of the owner-occupied mortgage market.

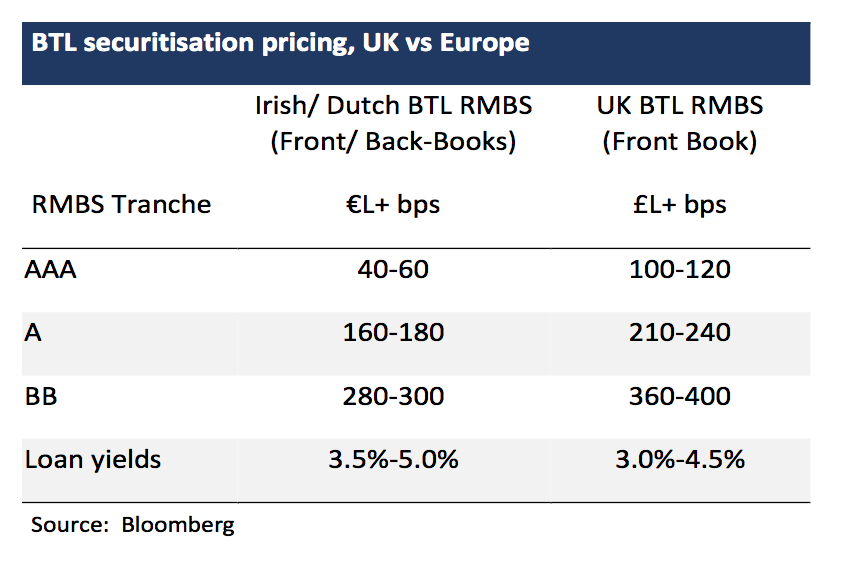

Any opinion on Irish or Dutch BTL RMBS valuations would be premature at this stage given that price discovery is still to come in the case of front-book securitisations. Clearing spreads on recent legacy (part BTL) RMBS may provide a useful guide in this regard (see table below), however we have yet to see whether the market will demand any premium for unseasoned assets from lenders often without meaningful operating track records. Still, front book ‘2.0’ securitisations from these emerging BTL markets look poised to price inside of UK equivalents, with this disparity explained by differences in current market technicals more than any credit or other fundamental factors, in our view. Conversely, this relative richness of Euro securitised product likely underscores the appeal of RMBS funding for the owners of emerging BTL front-books in Ireland and the Netherlands.

Owners of specialist BTL lenders in Ireland and the Netherlands comprise alternative investors for the most part. Their venture capital via unlisted equity stakes in such front-book lenders looks to have been a rewarding trade by most accounts. For one, yields on the underlying BTL whole loans generally surpass returns on any comparable listed corporate or structured credit, notwithstanding the liquidity give-up. But taken together with the achievable term leverage costs via RMBS as outlined above, the risk/ return pay-off to equity looks to be very compelling. To make our point, we note that – based on simplistic assumptions using current average book yields adjusted for running (and amortised upfront) costs of say 1% and accounting for the cost of leverage currently available via RMBS – direct investors in Dutch and Irish BTL lenders holding 5% of retained equity would extract roughly 2x and 3x higher returns, respectively, than hypothetical RoEs in a comparable UK BTL lender. (These observations, which ignore losses, are bordering on being speculative of course, and are only meant to illustrate the early-stage equity investment appeal of new BTL markets like Ireland and the Netherlands relative to the more established UK market). Outsized equity returns, which stem largely from lower securitisation funding costs (currently at least) and, to a lesser extent, the modestly higher loan yields, can of course be expected to normalise as the BTL markets mature further. Concurrent with any such economic maturity, early stage private equity stakes in specialist lenders would also likely then be rotated into other ownership formats. Public listings or conversion to banks may count among them, ultimately.

Credit performance among Irish and Dutch front-book BTL mortgages over recent years is still largely indistinguishable from their respective owner-occupied mortgages, exhibiting low delinquencies and defaults thus far. We expect these benign trends to continue over the foreseeable future, assuming of course the current strong housing market tailwinds and bullish residential property investment economics prolongs. Looking holistically at the asset class (that is, ignoring the format or structure of capital market instruments to come), we would consider the following points as key investment considerations for BTL 2.0s going forward:

- Loan quality and underwriting discipline, any slippage in the latter being a key consideration as the market matures. In our view, any creep of legacy BTL refis into front-books would also be important to watch in the case of Ireland, particularly given potential re-default risks among loans in earlier forbearance. For now though we would see the current BTL vintage as being superior in quality to anything from the pre-crisis era, whether in terms of loan or borrower profiles

- Residential property market conditions are of course important bellwethers for BTL credit performance. While it is hard to imagine another housing crisis of the scale seen in the last cycle, we note nonetheless that both Ireland and Netherlands have witnessed sharp (almost exponential) upswings in house and rent prices in the recent past, with such momentum naturally expected to be exhausted in due course. The UK market has provided clear testimony that BTL payment behaviour can remain largely immune to housing market ‘soft-landings’, but the 2008/9 Irish experience provides equally compelling evidence that BTL credit sensitivity to house price direction becomes far more manifest in any extreme downside scenarios

- BTL landlords generally have long-term holding horizons when investing in residential property in any of these markets. We believe the historic resilience of UK BTL credit performance over ‘normal’ cycles – or indeed outperformance relative to owner occupied mortgages – can be partly attributable to this staying power. A key investment consideration going forward would therefore be any change to landlord investment mindsets, particularly as continued above-normal returns from property risks drawing in speculative or short-term ‘trading’ behaviour into the BTL loan markets

- Unlike the earlier generation of non-bank lenders, the contemporary specialist lender constituencies in these newer BTL markets are mostly owned by alternative/ private equity investors. We would surmise that such ownership can carry rewards and risks in equal measure. On the one hand, most of such investors have demonstrable finco experience and enough financial firepower to support and further develop the competitive viability of specialist lenders. On the other hand, the long-term commitment of such investors to these platforms in any period of prolonged credit and/or liquidity stress is as yet uncertain. BTL specialist lenders may be considered strategic assets for some investors, but unlikely for all.

The Irish Buy-to-Let Market

Rising from the (crisis) ashes

The Irish buy-to-let market dates back to the pre-crisis era, during which period investment mortgages related to residential property tended to be blended along with small-ticket CRE-like lending. Most of the country’s banks were lending readily in this space in the run-up to the financial crisis.

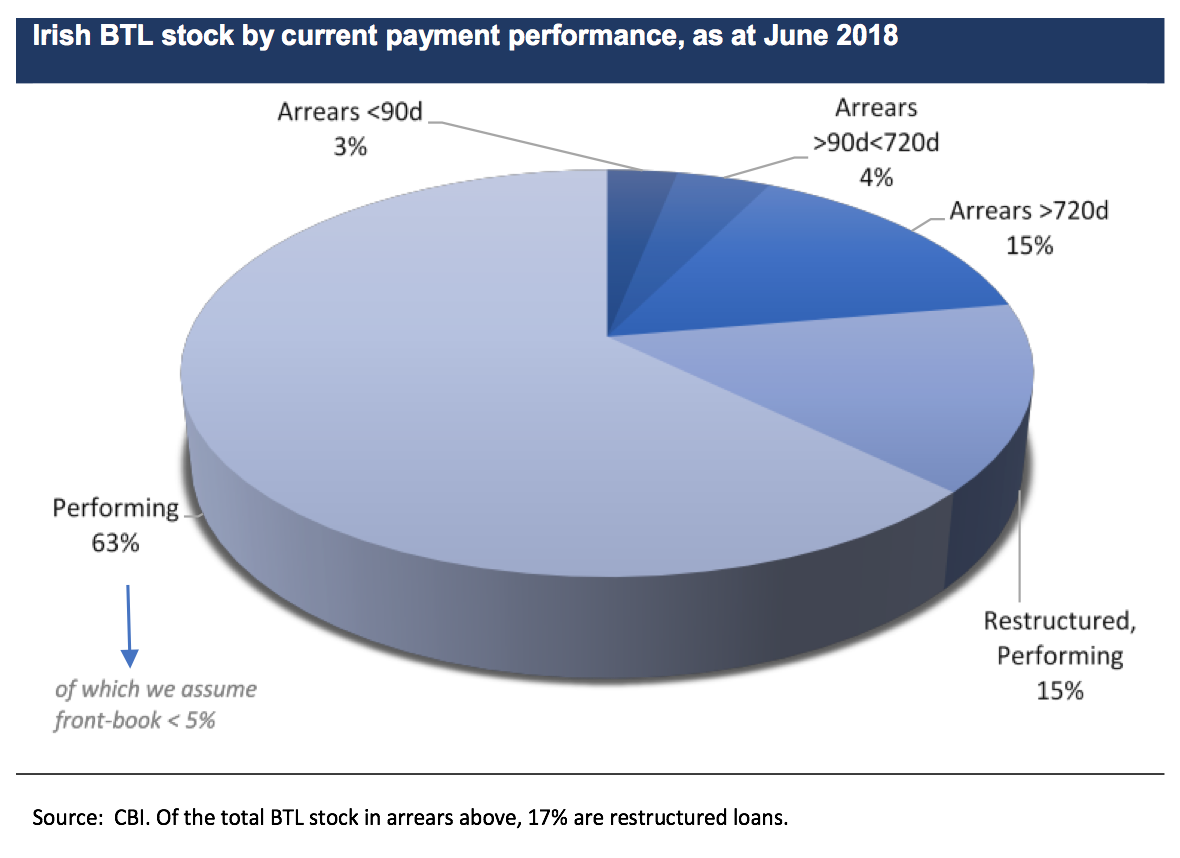

The severe housing market recession that followed took an unprecedented (matched only by Iceland among developed economies) toll on the Irish housing market, an event that is of course by now very well-documented. Against the backdrop of the ca. 60% collapse in house prices, the crisis aftermath saw late-stage delinquencies among owner-occupied loans rise to around 16% according to the CBI, with buy-to-let/ investment mortgages experiencing more severe arrears rates (up to 26%). Actual repossession rates were flattered by the national mortgage resolution measures (or MARP) enacted in 2013 aimed at mitigating the default shock via loan modifications, a programme that also served to moderate mortgage delinquency rates in the subsequent years. (BTL loan mods were mostly in the form of arrears capitalisations and term extensions). However, with MARP generally prioritising owner-occupied loans over BTLs, delinquency rates in legacy buy-to-let mortgages have remained stubbornly high, at 22+%. The overall mortgage stock in Ireland that remains impaired is still noticeably high at 17%.

There are reportedly 175k buy-to-let landlords in Ireland, with 120k BTL loans outstanding. (We assume this loan stock excludes financing provided to REITs and other institutional landlords, which make up a relatively significant share of owners of rented stock in Ireland). We understand that a fair share of existing BTL loans were re-classified as such, having been originated as owner-occupied mortgages but where the properties were left unsold when the owner moved. (In most cases the desired sale price was unachievable, leaving such “accidental landlords”).

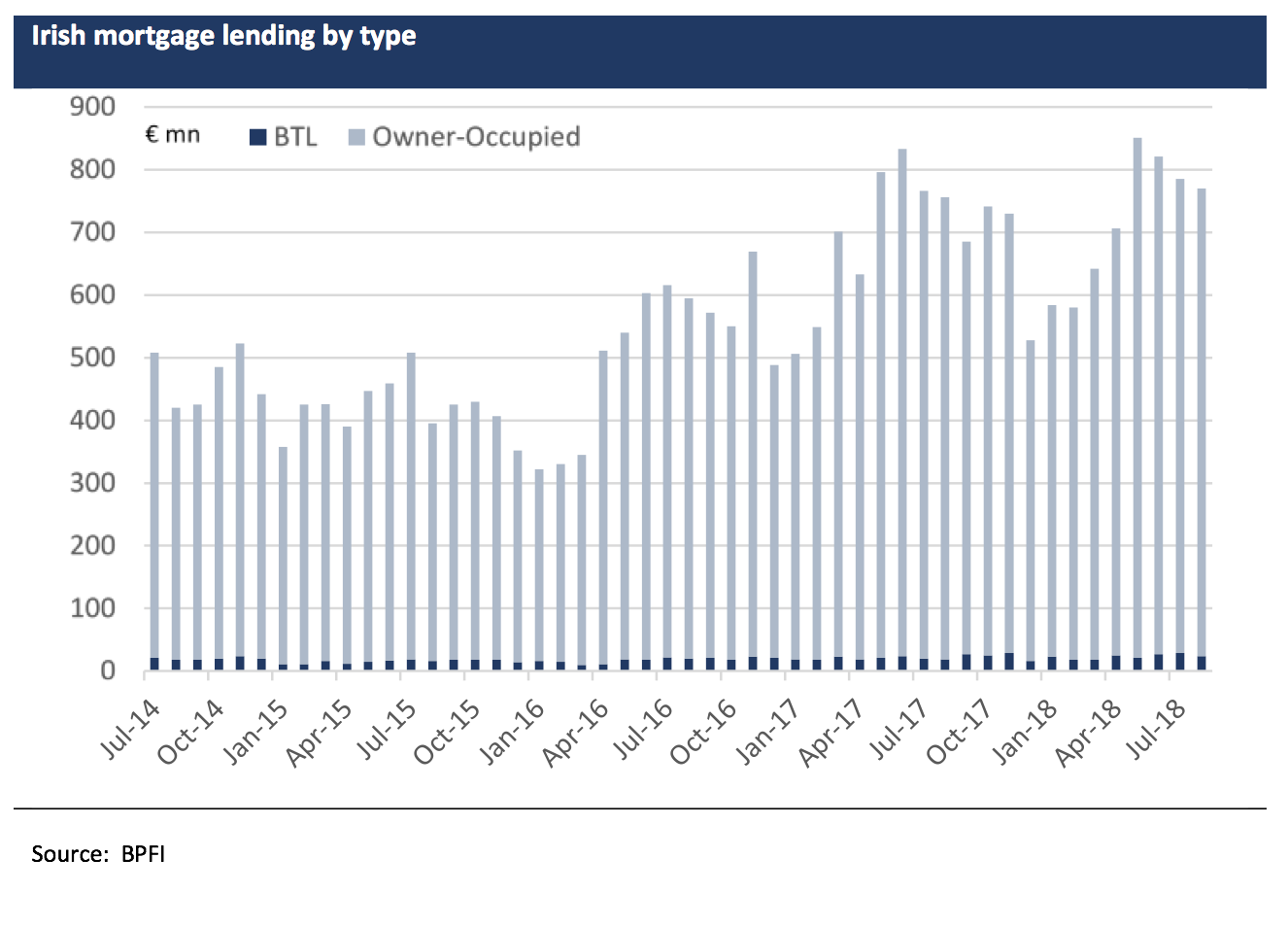

Given this legacy BTL overhang, coupled with the substantially greater associated demands on regulatory capital, the resumption of fresh BTL lending by banks since 2014/15 has been tepid by any measure. While most banks have BTL products on offer (to include PermanentTSB, BoI, Ulster, KBC, AIB), buy-to-let ‘2.0’ lending is currently running at only around €280m per year according to the BPFI, or no more than 3-4% of total front-book mortgage originations in Ireland. Indeed, the existing stock of Irish BTL mortgages continues to shrink with back-book repayments significantly outpacing any new lending.

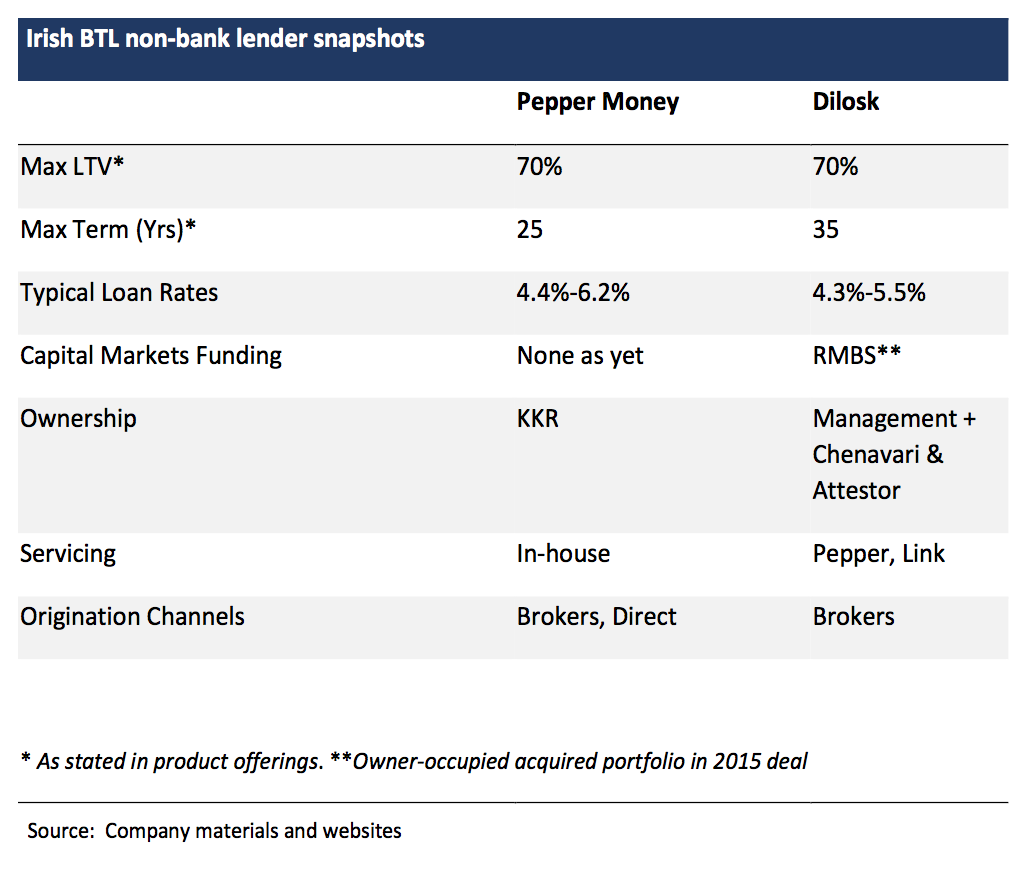

Yet the footprint of newer non-bank specialist mortgage lenders in the BTL front-book re-emergence has been notable in our view, notwithstanding the infancy of the BTL 2.0 market. We estimate based on both anecdotal and official data that the share of non-bank lending has doubled since 2016 and currently represents up to around 30-40% of all BTL lending in Ireland, or roughly €100-120m annually. The likes of Dilosk and Pepper Money dominate the non-bank lender base for now, with a few others such as Finance Ireland reportedly considering entry into Irish BTL lending.

New BTL lending in Ireland is typically done at LTVs between 60-70%, in sharp contrast to legacy loans which are mostly still in negative equity (CLTVs>100%). BTL LTVs reflect macroprudential guidelines that were put in place in 2015, which prescribe 70% limits on BTL lending, with allowances for 10% of lender books to be in excess of this threshold. (This BTL limit compares to 80% LTV and 90% LTV limits on owner-occupied and first-time buyer loans, respectively). According to recent CBI monitoring information, the bulk of Irish BTL lending done since 2015 is within the regulatory limit, with less than 3% of new loans above this cap. Aside from LTV considerations, lenders usually underwrite to a minimum 1.2x rental income coverage of loan principal and interest.

Irish BTL lending by non-banks is typically limited to the unregulated sector, which is broadly defined as lending to professional landlords whereby loans are not covered by the same degree of consumer protection as regulated lending. Like the UK, the definition of what constitutes a professional landlord is not prescribed – most lenders to our understanding normally deem BTL borrowers with three or more investment properties as being ‘professional’. Loans are also commonly provided to corporate and SPV structures, including pension trusts (where gearing is capped at 50% LTV). What little Irish front-book securitised loans there are suggest that BTL borrower stated incomes are generally 20-30% higher than borrower incomes in the mainstream mortgage market.

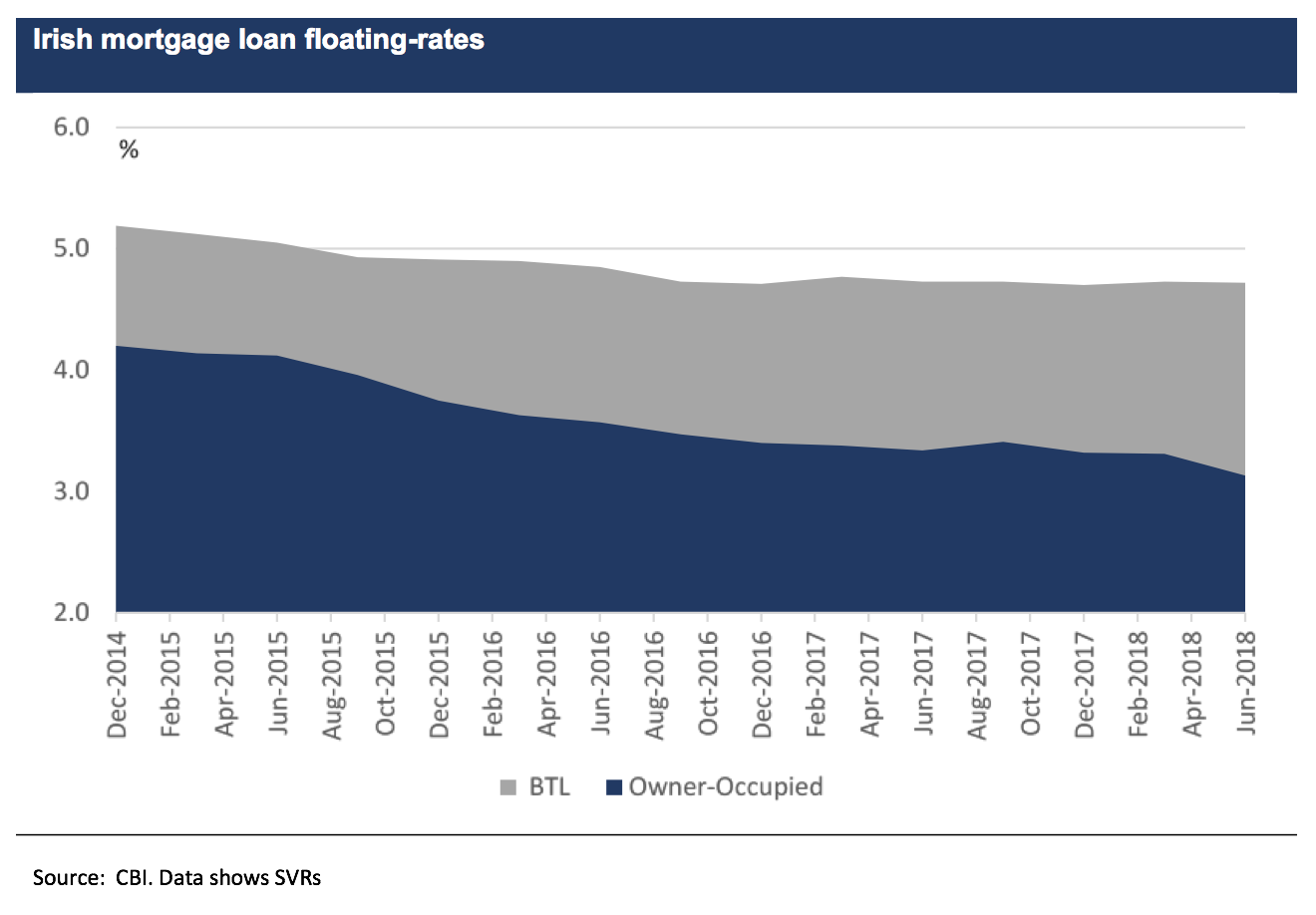

Irish BTL loan formats generally mirror product types prevalent in the owner-occupied market. Most loans are floating rate (with fixed teasers sometimes) and up to 25 years in tenor. Lending margins range from 4.2% to over 5%, with bank originated product typically in the lower end of this range. BTL loan margin premiums over owner-occupied product stands at around 150-175bps currently, having proved stickier in recent years relative to the margin compression seen among owner-occupied loans.

Servicing is a mix of in-house and use of third parties, with the latter industry still somewhat shallow, certainly when compared to the UK, or Netherlands for that matter. Default management of non-regulated buy-to-let loans is appreciably more straight forward relative to owner-occupied loans, which are subject to forbearance under MARP, in effect ensuring that legal proceedings are only initiated for borrowers if no restructuring solution can be found. By contrast, enforcements on non-regulated buy-to-let loans are mostly out-of-court proceedings that allow creditors to expediently take possession in cases of borrower default, in contrast to the lengthy procedure required for mainstream, regulated loans. Similar to the UK, the Irish system provides for “receivership of rent” in cases of borrower default, whereby rental income is diverted from the non-performing owner/ landlord to mortgage lender.

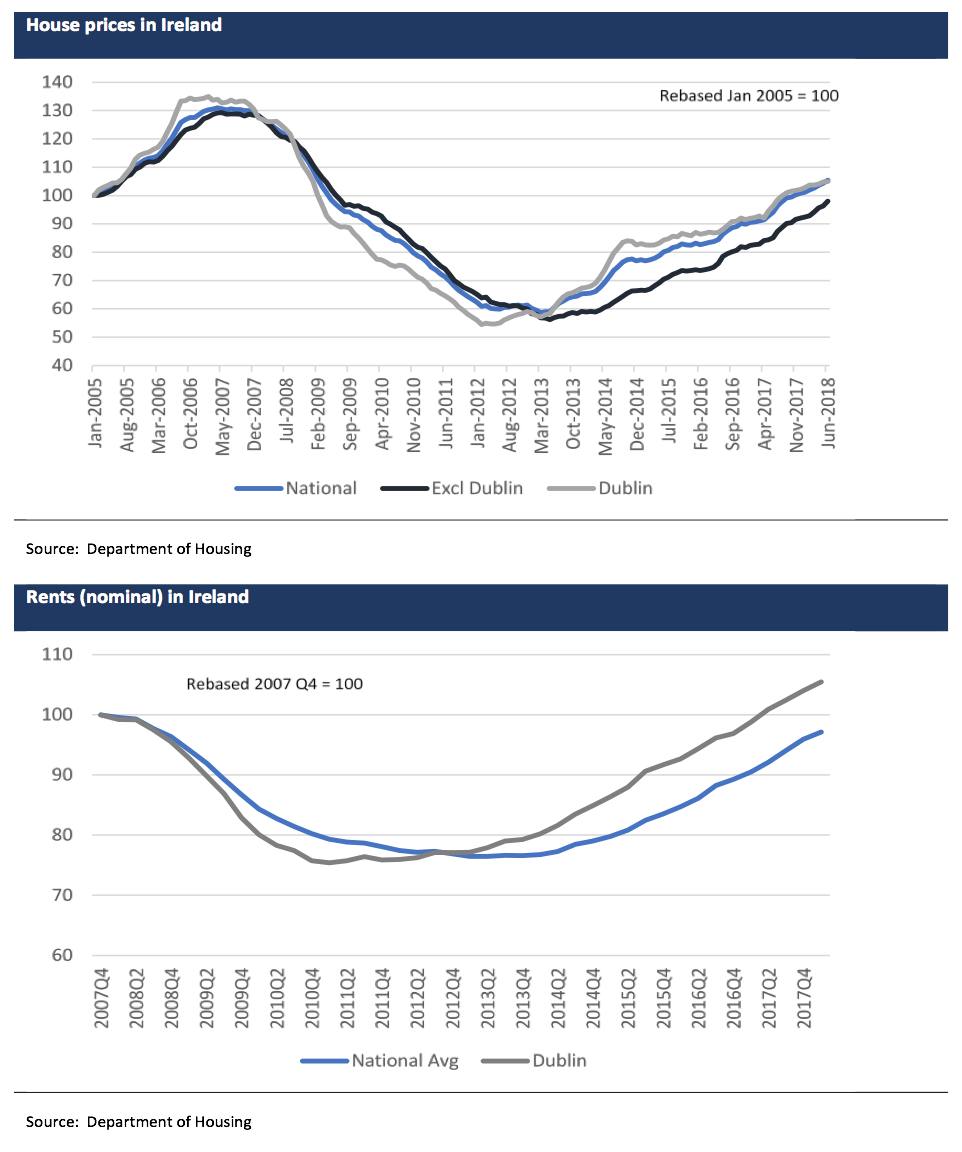

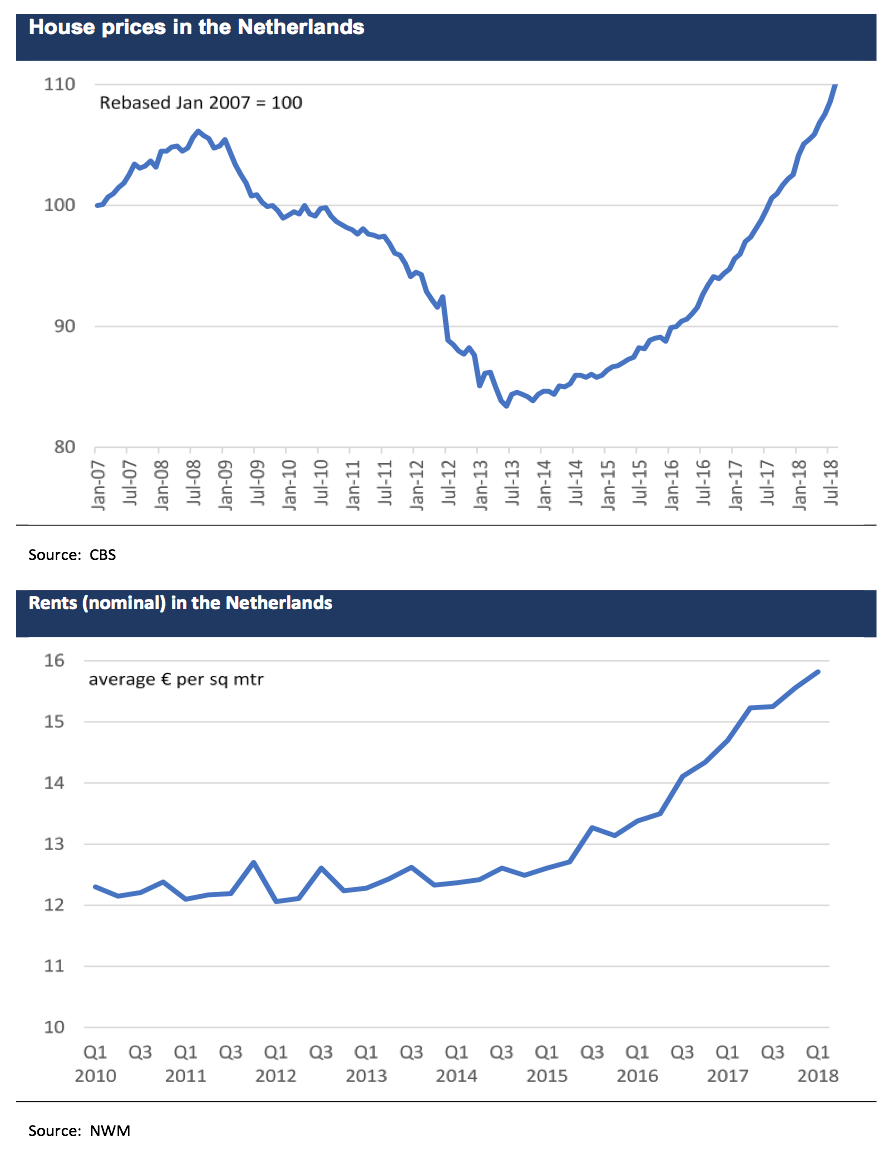

In terms of housing market fundamentals, the recovery since the market depths of 2012/13 has been appreciable, certainly if measured by housing price and rent dynamics. Evidence indicates that this recovery is driven by the shortage of housing rather than being credit-fuelled, at least thus far. House prices have posted double-digit growth in recent months, with year-on-year gains having peaked at over 20% (and 28% in Dublin) at the early stages of the post-crisis upswing. However, despite the significant house price inflation seen in recent years, house prices remain some 20% below the peaks reached during the pre-crisis era.

By contrast, rents (all property types) nationally are just a fraction lower than the peaks seen in 2006/7, with rents in Dublin currently surpassing the previous record high. Isolating the private rented sector, levels are currently at their highest recorded value, approximately 17 per cent above the pre-crisis peak. Recent rent yoy growth has ranged from 6-12% nationally excluding Dublin, wherein the growth has reached up to 14%. Indeed, these growth rates are lower than what was seen earlier in the cycle, with this moderation arguably explained to some extent by the introduction of Rent Pressure Zoning at the end of 2016, which essentially caps rental increases in designated zones to 4% annually, enforceable for up to three years. (There are currently 21 such designated areas in Ireland). Like sale prices, rental price inflation has been fuelled by the shortage in rental properties. (According to property website Daft, the nationwide stock of available rentals is near its lowest since data was first collected in 2006). Currently ca. 30% of households in Ireland rent rather than own, with this ratio under 22% ten years ago. The long-term trend in this respect highlights an interesting pattern – the share of households renting fell perceptibly over the multi-decade post-war period, reaching a low of 18% in 1990 before increasing steadily again.

As highlighted earlier, rental yields in Ireland remain very high compared to other economies, ranging from 5-8% typically. Investment economics have been further bolstered by recent tax changes, namely the re-starting of tax relief on BTL mortgage interest payments from 2017, with such credit having initially been provided for 75% of payments, currently 85% and due to increase steadily to 100%. This recent friendlier tax treatment reverses its abolition in 2009, an outturn that is in distinct contrast to the UK where BTL interest tax offset benefits are scaling steadily lower.

The capital market for Irish buy-to-let risk is, thus far, limited to a few securitisations where the overwhelming component of portfolios comprised legacy BTL loans, typically dating back to 2006/7 vintages. On our count, the amount of performing BTL loans securitised thus far (isolating such components among RMBS issued) has totalled around €1.5bn, with some of the bonds retained by the issuing banks. A further ca. €150m of non- and/or re-performing BTL loans have also been securitised, in which the loans are in varying stages of the restructuring or enforcement process. As yet there has been very little by way of front-book BTL assets that have come to the capital markets, though we expect this to change going forward, as discussed in the earlier section.

Flows in Irish whole loan NPL portfolios have been far more prevalent relative to any securitisations over the post-crisis period of course. We estimate that some €15bn of non-performing residential mortgage portfolios have traded since the crisis, with the buyers being private equity firms for the most part. Of this amount, buy-to-let loans featured relatively prominently. As recent examples, Ulster sold a €1.4bn NPL mortgage back-book that includes ca.€740m of BTL loans to borrowers in forbearance arrangements, while KBC sold a mixed NPL loan portfolio containing Irish (and UK) BTL loans. Some of such loans may be potentially refinanced in the RMBS market following satisfactory workouts, but we would expect any such deal flow to remain distinguishable to front-book BTL RMBS.

The Dutch Buy-to-Let Market

Still a novel product type

Unlike the UK and Ireland, mortgages for residential property investments in the Netherlands have not historically been distinguishable in lending practices nor within the mortgage regulatory framework. Similar in that sense to a number of other core European mortgage markets (Germany and France, among others), Dutch buy-to-let mortgages were largely inseparable from the suite of mortgage products offered by banks. Data on the legacy stock of such mortgages is not available therefore, though we understand that such bank originations were not altogether uncommon in the pre-crisis era. (We would remark at this point that Irish BTL data is noticeably richer than for the Netherlands).

Largely influenced by more punitive capital costs in the aftermath of the crisis, banks all but ceased investment mortgage offerings from around 2009. The first bank to reintroduce buy-to-let mortgages in select Dutch cities was NIBC in 2015, with the launch product capping LTVs at 70%. To our knowledge, NIBC remains the only major bank in the Netherlands to offer ‘2.0’ investment mortgage loans. But the genesis of the Dutch “buy-to-let” label arguably stemmed from the targeted or specialised lending activity from the small segment of non-banks, which were also relatively active by 2015/16. As discussed further below, the emergence of specialist lenders coincided with noticeable structural shifts in rental demand and landlord investment appetite in the Netherlands.

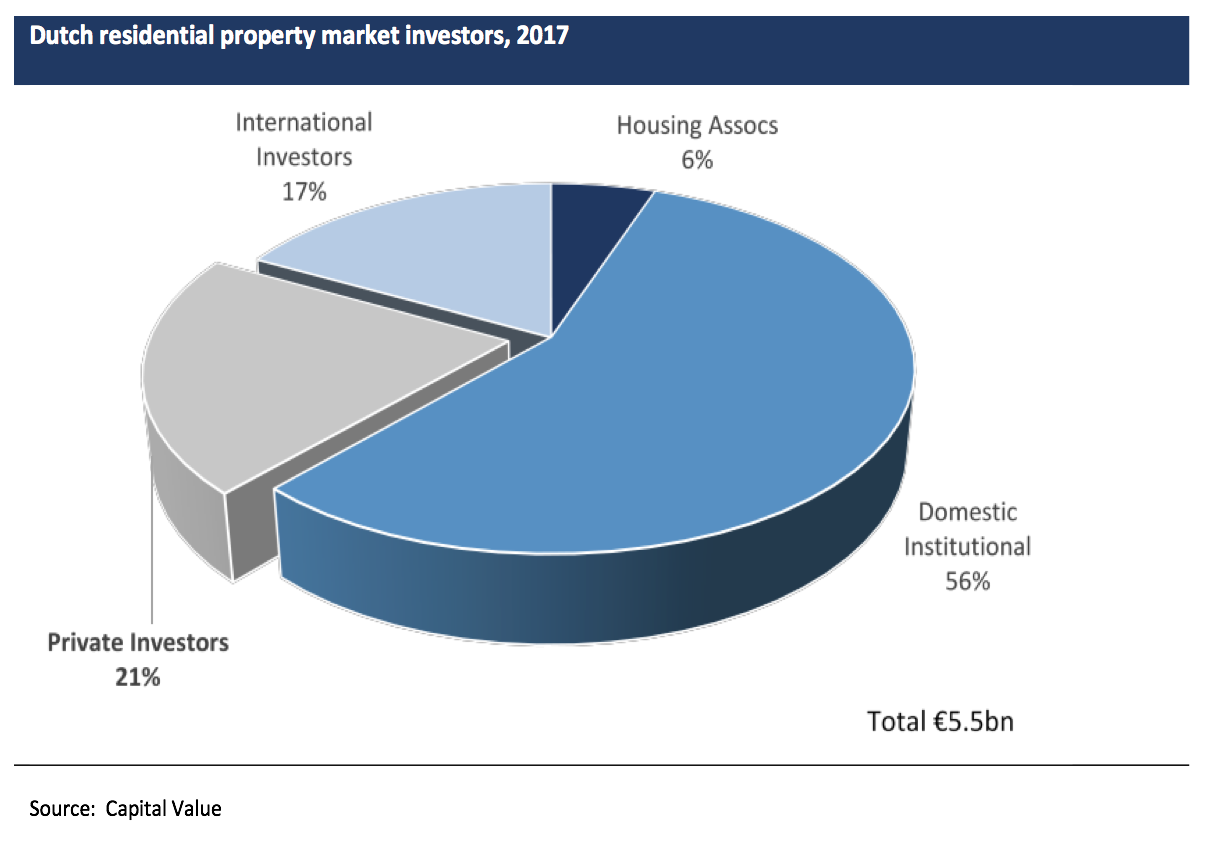

Yet all things considered the Dutch mortgage market that is defined as “buy-to-let” remains at an embryonic stage, with the product type still barely commoditised. Anecdotal evidence points to appreciably increased residential investment activity in recent years, with for example Land Registry studies showing that 6% of all residential property transactions were investment-led in 2016, with this ratio climbing to nearer 10% by the end of 2017. (In urban cities like Amsterdam, this proportion was higher by another ca. 5%). Considering further that Dutch overall mortgage lending currently totals around €110bn annually (with a stock of €522bn), a simple – yet flawed in our view – interpolation would put BTL lending in the ca. €6-10bn region annually since 2016. We are simply unable to reconcile this figure with our data on origination volumes reported by NIBC and the two active non-bank lenders (namely, RNHB and Domivest), data which collectively suggests annualised BTL lending as closer to €600m. Even allowing for potential lending activity from other smaller BTL lenders, we would infer that BTL lending in the Netherlands does not exceed €1bn per year currently. This would be more consistent with reported data showing private investors transacting €1.15bn in residential property investments during 2017. (See chart above). We assume therefore that a sizable share of current residential investment transactional activity is being financed away from the BTL mortgage markets, likely reflecting institutional purchases using commercial financing.

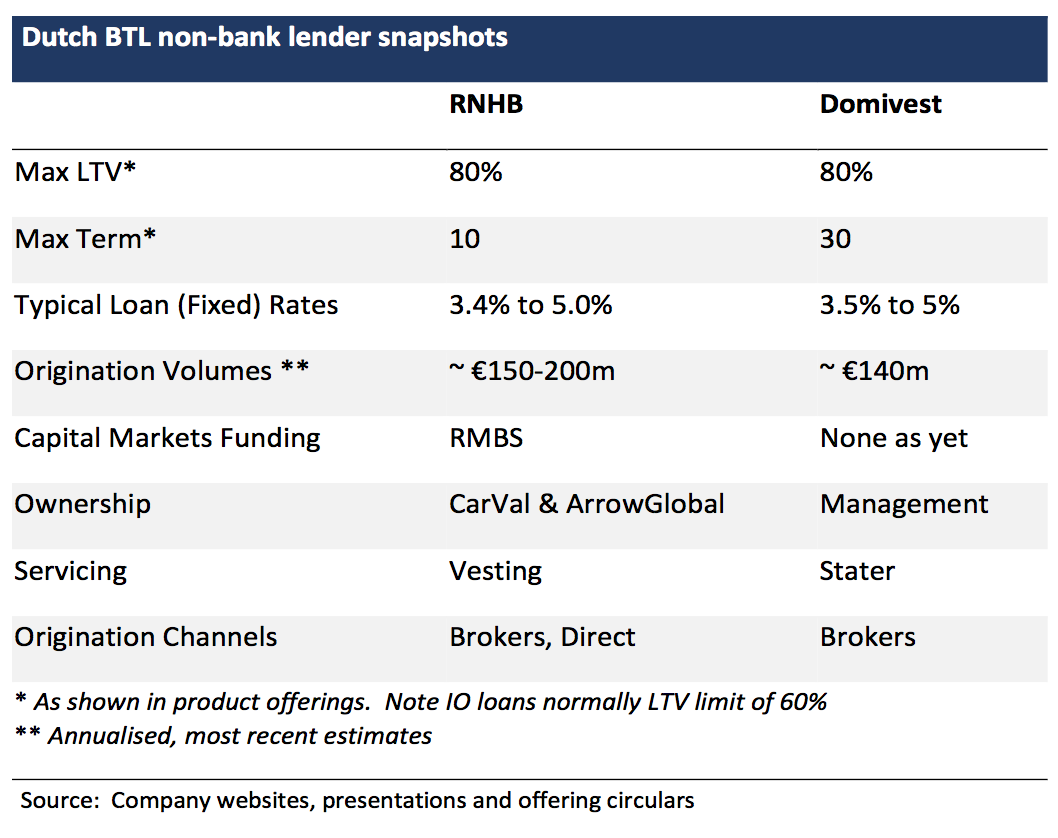

Still, fresh BTL lending of up to say €1bn annually in the Netherlands is considerable for a young product. And while the size of the BTL market – whether measured in flow or stock – is still overshadowed by the owner-occupied mortgage market (which, in turn, is disproportionately large relative to housing market size or GDP), the penetration of the very few incumbent specialist lenders in overall BTL origination volumes looks noteworthy. We think the non-banks own up to roughly 50% of new BTL lending. Aside from NIBC, the two other dominant lenders – RNHB and Domivest – are non-banks. RNHB, which is an established player in the mid-market CRE lending space as well as BTLs, was bought by CarVal and Arrow Global in 2016 from FGH Bank, a long-standing finance subsidiary of Rabobank. Domivest was organically founded as a dedicated BTL specialist in 2017 by principals formerly active in Dutch direct lending and asset-backed portfolio management.

Like in other BTL markets, these specialist lenders differentiate their product offering through leverage (up to 85% LTV) and the ability to underwrite more complex and/or off-the-run investment loans. Generally, however, lenders mostly underwrite to 80% LTV limits for repayment BTL mortgages or 60% for IOs. (This is corroborated by WA LTVs of 72.2% for the front-book component of the very recent DPF 2018 securitised portfolio, for instance). Importantly, valuations are normally derived from rented value metrics, typically at haircuts to market values. Dutch BTL loans are typically also underwritten to 1.25x rental interest coverage limits, with a more lenient cap of 1x or 1.05x normally employed in the case of full (P&I) debt service coverage thresholds. Lender criteria usually also comprise exposure limits in terms of loan amounts, borrower and regional concentrations.

Unlike other BTL markets, as well as the Dutch owner-occupied market, there are no specific macroprudential guidelines for buy-to-let mortgages at this stage. Therefore, lending appetite and disciplines are formed out of business models for the most part, rather than shaped by industry-wide rules. Principally, BTL loans are underwritten to the assets/ rental cash flow rather than borrower income, which in turn side-steps regulatory requirements and restrictions around mainstream mortgage lending. Similar to other BTL markets, this necessarily requires BTL borrowers to be deemed as “professional” rather than consumers. BTL lending by banks and non-banks alike in the Netherlands is currently only offered to prime borrowers, in so far as having a clean (or fully discharged) delinquency record with the Dutch credit bureau BKR.

One idiosyncrasy of Dutch BTL origination practices is the lending to syndicates, or “risk groups”, where multiple borrowers assume mortgage debt that is collectively secured over all of the underlying properties of the syndicate. Each BTL borrower in such risk groups is liable on a joint-and-several basis. Risk considerations in this regard can be further complicated given that a borrower can be a constituent in multiple risk groups with cross-default provisions.

This complexity aside however, the BTL product in the Netherlands is – in our opinion – simpler or more vanilla in format relative to the distinctly elaborate owner-occupied mortgage, which historically was originated as ultra-long duration (up to 75 years), 100%+LTV loans, often structured as IOs with savings plans embedded. (The reason of course for such unique product characteristics was because of the full tax deductibility enjoyed by owner-occupied mortgages – as we outline below, tax and other changes since 2013 are leading to a more normalised mainstream mortgage market). BTL loans are typically fixed rate with linear amortisation schedules, often with residual balloon redemptions. BTL loan terms tend to be shorter than owner occupied product with rate resets at 1, 3,5,7 or 10 years normally, in effect therefore having an implicit refinancing element. (Judging by securitised portfolios outstanding, BTL prepayments appear relatively high with lifetime CPRs around 17%).

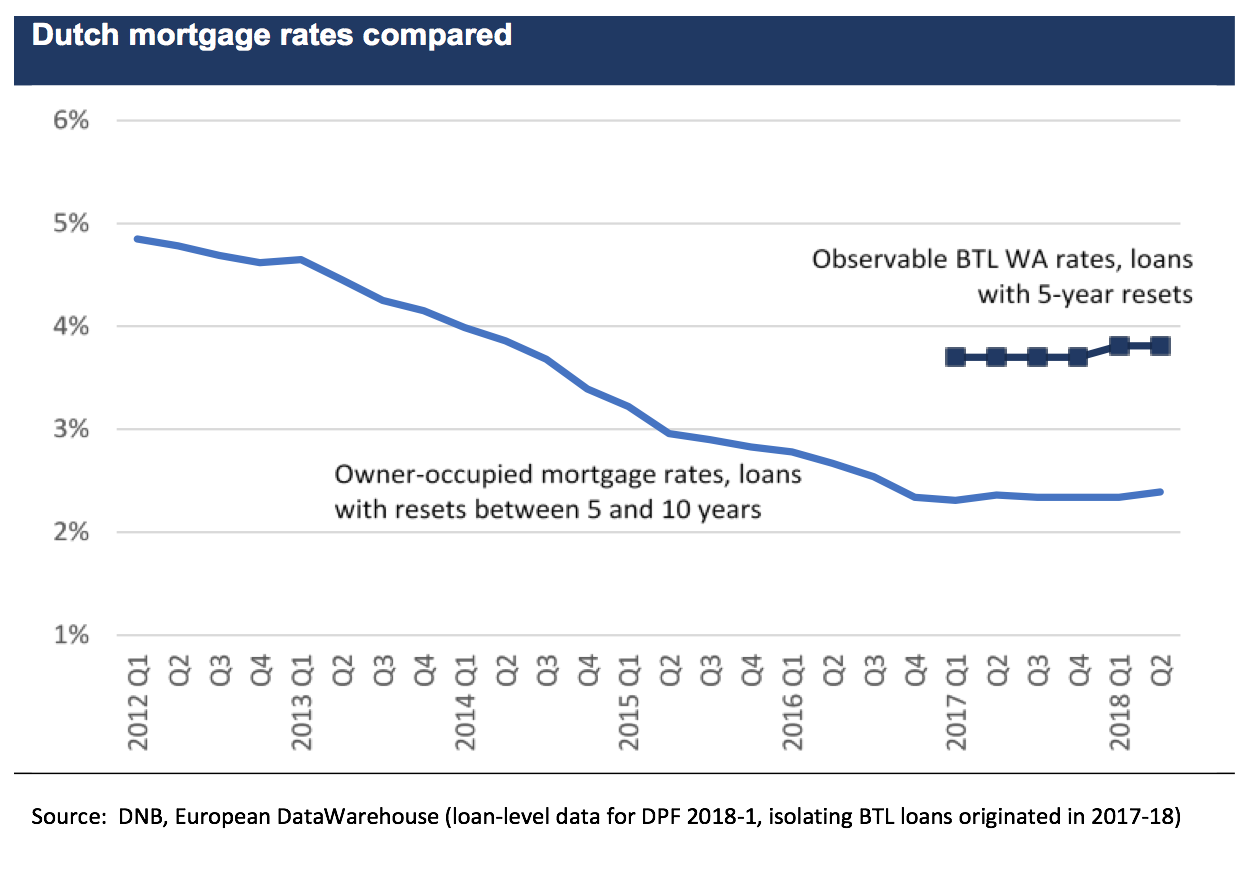

Lending yields on buy-to-let loans from the non-bank platforms typically range between 3.5% and up to 5%. (We note from loan-level data, for instance, that BTL loans originated since 2016 in the most recent Dutch securitised portfolio had an original weighted average rate of 3.76%). By comparison, central bank data show that owner-occupied mortgage rates are currently between 2% and 2.4% for loans with resets under 10 years. Therefore, the BTL loan yield premium over mainstream mortgages is around 140-150bps, only modestly inside (unadjusted for swaps) lending premiums in markets such as Ireland. However, unlike other BTL markets, lending rates offered by banks (NIBC namely) and the non-bank lenders seem indistinguishable by comparison.

Among the non-banks, BTL loan servicing – to include default management and recoveries – is undertaken by third parties. This practice is unremarkable considering what is one of the most established and deepest mortgage servicing industries in Europe.

Loan enforcement and mortgage repossession processes in the Netherlands are notable for being among the most seamless and expedient in Europe, with BTL mortgages benefiting equally. But unlike the UK or Ireland, there is no legal concept of “receivership of rent” in cases of prolonged delinquency, though in practice lenders incorporate pledges over the rental cash flow which can be enforced on any uncured arrears. However, we understand that such contractual provisions are unenforceable if the borrower seeks credit protection under bankruptcy. (This is in contrast to the UK). A key disincentive to non-payment in the Netherlands is the inclusion of borrowers into the BKR register once 90 days past due – in the case of BTL borrowers therefore, this means that any late-stage delinquency will have direct consequences for their personal credit status. In the UK or Ireland, such end-impact on personal credit scores is not a given in cases where BTL loans are unguaranteed.

The Dutch property rental market has witnessed extraordinary structural shifts in the past 7 years or so that has fuelled a demand squeeze, as evident more recently. The confluence of different, coinciding factors resulting in the current rental market dynamics include:

- Legislative changes in the aftermath of the 2008 crisis designed to reduce the dominance of social housing associations, which included for example tighter means-testing for tenants, had the effect of forcing higher income dwellers into the private rented market. There are 2.3m rented dwellings in the Netherlands according to official statistics, but some 80% of this stock is (still) owned by social housing associations, the highest such ratio in Europe. All that aside, the Dutch population is growing at its fastest pace in over 15 years

- The policy changes also encouraged the rotation of rented dwelling ownership from social housing (regulated) entities to the (unregulated) private sector, but such liberalisation has been slow, certainly outpaced by the growth in demand for private rental properties. There are 600k dwellings in the unregulated (meaning no rent control) rental sector, but the bulk of this stock is still owned by social housing associations, which have been challenged in optimally managing such properties as de facto private landlords. We understand from lenders that the stock of privately owned non-regulated rented dwellings may be around a mere 113k

- Dutch owner-occupied mortgages came under macroprudential measures in 2013, mirroring similar developments in other ‘high-growth’ mortgage markets in Europe. Such measures included LTI limits and other income affordability tests, LTV caps at 100%, loan term limits and restrictions on mortgage interest tax deductibility to amortizing loans only. Coming from a market that was made up predominantly of ultra-long IOs with foreclosure value-based LTVs typically in the 125%+ range, the new rules took a toll on mortgage demand, in effect increasing the appeal of renting over owning.

Against the backdrop of the above market shifts, rental demand has increased sharply in recent years, outstripping supply. According to official statistics, the net demand for rental housing rose from -188k (i.e., surplus demand) in 2009 to 47k in 2012, increasing since then to an estimated deficit of 205k in 2017. Rent inflation has climbed steadily from the end of 2014 to reach double-digit yoy growth by 2017 (currently 7.6%). These overall nationwide figures understate the degree of rent increases seen for private residential properties in the urban areas.

Indeed, the Netherlands has one of the highest property rental yields in Europe, as was highlighted in the earlier section. (We would caution that headline yields have likely dropped more recently with the continued sharp increases in house prices). Coupled with the outperformance of residential property prices over the past four years, the BTL investment proposition has become steadily more compelling as an alternative savings channel in an otherwise low-rate environment. Following a prolonged post-crisis correction, Dutch house price growth has accelerated since the lows reached at the end of 2013, with monthly yoy growth of between 7% and nearly 10% in the past year alone. Like Ireland, there is little to point to the recent house price rally being credit-fuelled, rather supply-demand imbalances look to be the main price driver.

In contrast to the UK or Ireland, Dutch BTL borrowers do not benefit from any direct tax relief from the deductibility of mortgage interest as there is none allowed for investment mortgages. There is, however, some tax-related upside given an unconventional framework that derives the taxable amount for an investment property by applying notional yields (ranging between 2.87% and 5.39%, depending on asset value) to the net worth (i.e., equity value) of the BTL property, and deducting an allowance. A flat tax rate of 30% is then applied. While the exact formula and notional yields used can vary depending on tax filing status, the net outcome is often an effective tax rate that is relatively attractive compared to the tax-take on other income or investment returns.

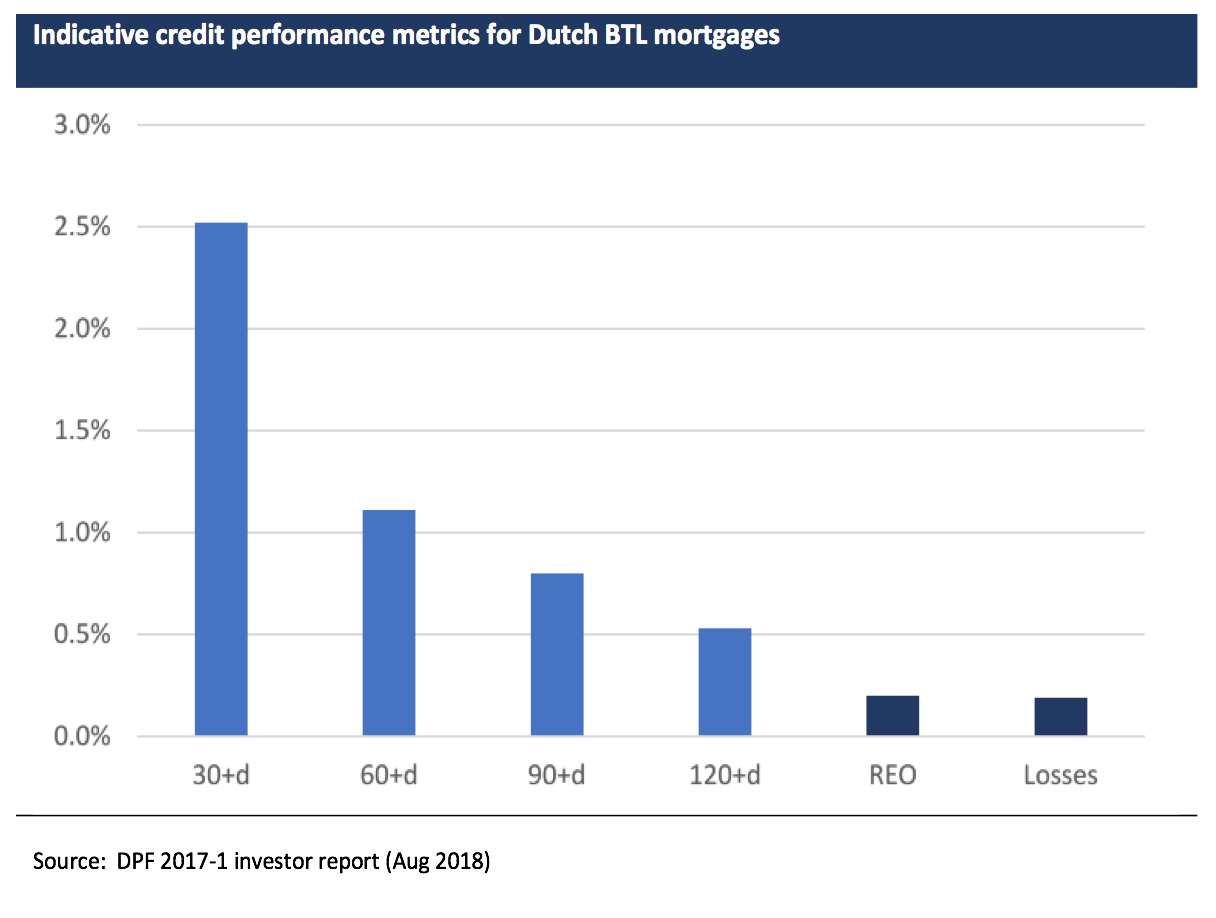

The credit performance of Dutch BTL mortgages – to the extent reliably inferable from existing securitisations – looks to be broadly consistent with the owner-occupied mortgage market, which of course boasts one of the strongest credit trends among ‘tradable’ mortgage markets in Europe. Based on available data from the DPF 2017 securitisation, headline delinquencies are moderately higher than the norm seen among owner-occupied portfolios, but defaults and ultimate losses are broadly similar. In the absence of available loan-level data, we would hazard an educated guess that the bulk of arrears relate to the more seasoned loans pre-dating the housing recession in 2009-13, with delinquencies being far lower (likely negligible) among front-book BTL loans. If this is correct, we would see the extent of legacy loan arrears as being remarkably contained considering the ca. 20% house price fall in the intervening period, which is also captured by the presence of 100%+ CLTV seasoned loans.

To-date, Dutch BTL representation in the capital markets has been via only two securitisations from RNHB, totalling just under €1.3bn. Both deals comprised a significant portion of legacy mortgages (reflecting FGH’s original portfolio), with front-book loans limited to ca. €470mn of the total securitised pools. (And of this amount, BTL loans are roughly half). Going forward, we expect more securitisations of new Dutch BTL lending. But, as touched on in the earlier section, we also see wholesale funding sources for specialist buy-to-let lending coming from other capital market instruments other than RMBS, mirroring similar institutionalisation of the owner-occupied mortgage market in the Netherlands.

Disclaimer:

The information in this report is directed only at, and made available only to, persons who are deemed eligible counterparties, and/or professional or qualified institutional investors as defined by financial regulators including the Financial Conduct Authority. The material herein is not intended or suitable for retail clients. The information and opinions contained in this report is to be used solely for informational purposes only, and should not be regarded as an offer, or a solicitation of an offer to buy or sell a security, financial instrument or service discussed herein. Integer Advisors LLP provides regulated investment advice and arranges or brings about deals in investments and makes arrangements with a view to transactions in investments and as such is authorised by the Financial Conduct Authority (the FCA) to carry out regulated activity under the Financial Services and Markets Act 2000 (FSMA) as set out in in the Financial Services and Markets Act 2000 (Regulated Activities Order) 2001 (RAO). This report is not intended to be nor should the contents be construed as a financial promotion giving rise to an inducement to engage in investment activity.Integer Advisors are not acting as a fiduciary or an adviser and neither we nor any of our data providers or affiliates make any warranties, expressed or implied, as to the accuracy, adequacy, quality or fitness of the information or data for a particular purpose or use. Past performance is not a guide to future performance or returns and no representation or warranty, express or implied, is made regarding future performance or the value of any investments. All recipients of this report agree to never hold Integer Advisors responsible or liable for damages or otherwise arising from any decisions made whatsoever based on information or views available, inferred or expressed in this report. Please see also our Legal Notice, Terms of Use and Privacy Policy on www.integer-advisors.com