Navigating the Unknown

![]() Covid Impact on Alternative Credit_Integer Advisors (PDF Version)

Covid Impact on Alternative Credit_Integer Advisors (PDF Version)

Executive Summary

The following is an excerpt of our report (see PDF link for full version)

In this report, we look at the impact of the covid crisis on private and alternative credit markets in Europe, spanning mortgage, consumer and small-/ mid-cap corporate credit. On our estimates, this non-bank specialty lender-led market has a footprint of roughly €350bn in terms of loan stock, dominated by the UK.

The covid pandemic is of course an unparalleled crisis in its scale and intensity. And the policy-maker response has been equally without precedent, generally comprising a three-prong approach made up of exceptional monetary accommodation, emergency fiscal stimulus measures and loan forbearance initiatives. The response to the covid pandemic hitherto has already far surpassed policy actions taken during the 2008/9 crisis.

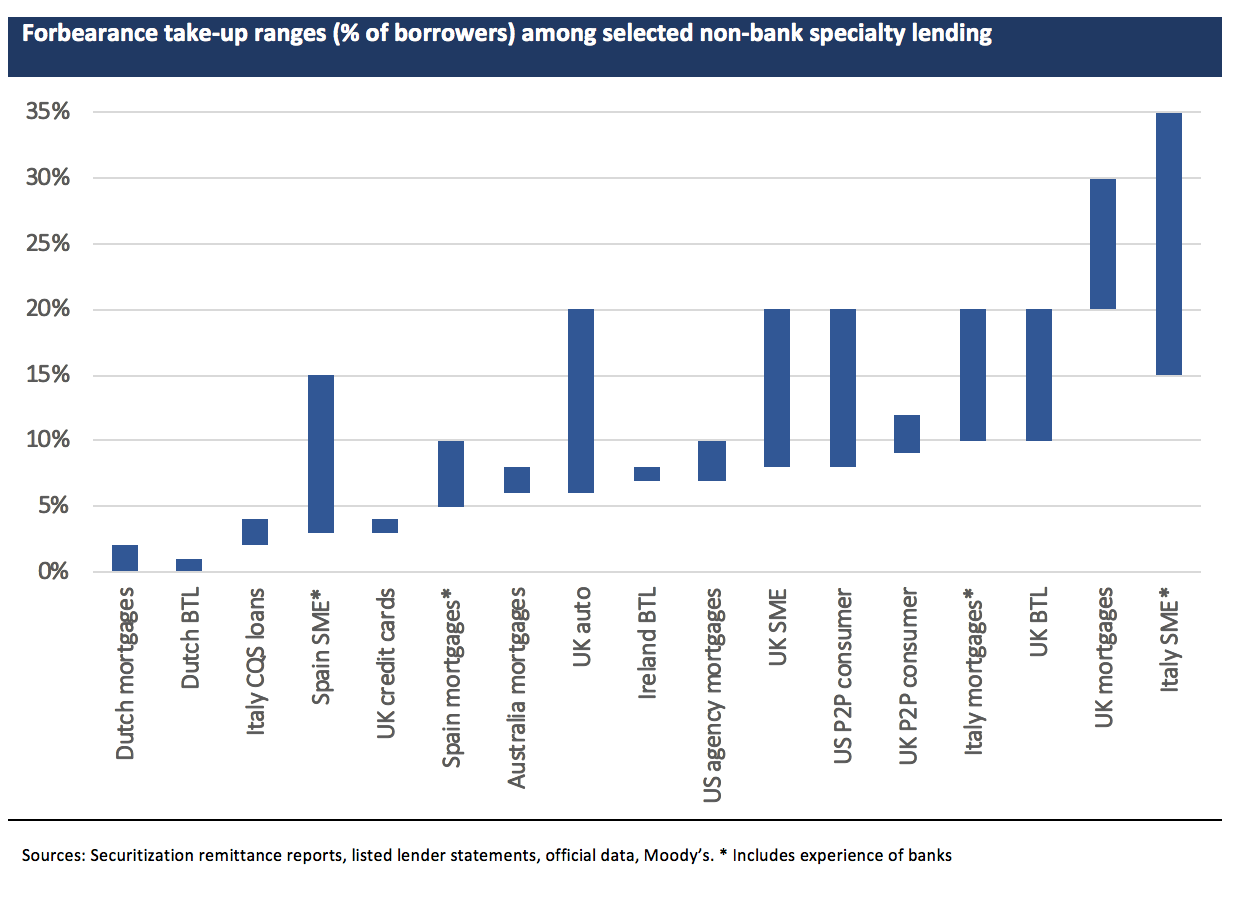

In the near-term at least, we feel the fiscal measures in place will provide appreciable support for debt servicing burdens while also cushioning any repayment shocks as some borrowers emerge from payment moratoriums. Household credit stands to benefit most in this respect, in our view. Rather than loan book credit deterioration, we see lender financing and/or liquidity distress as the main near-term casualty from the covid crisis, given the extent of forbearance on the one hand and the more selective liquidity within securitization and institutional funding markets on the other. (Non-banks and speciality credit assets generally fall outside central bank liquidity and asset purchase envelopes, with very few exceptions). This squeeze on many non-bank lender models may provide interesting private market ‘back-book’ opportunities in the coming months.

The longer-term crisis impact on private credit performance depends largely of course on its ultimate toll on employment and business survival. At this stage we see unsecured credit as being at most risk, save potentially for some higher margin loan books which may be insulated by adequately rich yields. Mid-cap corporate portfolios may also be vulnerable if default expectations in the larger-cap leveraged finance market is any guide. (Indeed, this crisis will be the first real test for private debt funds, and also for the likes of marketplace lenders). Residential mortgages should prove the most credit defensive, in our opinion.

Covid brings the 2010s alternative credit cycle to an abrupt end. In its aftermath, we see a fresh cycle of front-book opportunities re-emerging apace to coincide with renewed demand for specialty credit. Compelling risk-return economics (typical in any early-cycle lending) against the backdrop of prolonged ultra-low rates should underpin the merits of private loan book investing, once again.

Disclaimer

The information in this report is directed only at, and made available only to, persons who are deemed eligible counterparties, and/or professional or qualified institutional investors as defined by financial regulators including the Financial Conduct Authority. The material herein is not intended or suitable for retail clients.

The information and opinions contained in this report is to be used solely for informational purposes only, and should not be regarded as an offer, or a solicitation of an offer to buy or sell a security, financial instrument or service discussed herein.

Integer Advisors LLP provides regulated investment advice and arranges or brings about deals in investments and makes arrangements with a view to transactions in investments and as such is authorised and regulated by the Financial Conduct Authority (the FCA) to carry out regulated activity under the Financial Services and Markets Act 2000 (FSMA) as set out in in the Financial Services and Markets Act 2000 (Regulated Activities Order) 2001 (RAO).

This report is not intended to be nor should the contents be construed as a financial promotion giving rise to an inducement to engage in investment activity. Integer Advisors are not acting as a fiduciary or an adviser and neither we nor any of our data providers or affiliates make any warranties, expressed or implied, as to the accuracy, adequacy, quality or fitness of the information or data for a particular purpose or use. Past performance is not a guide to future performance or returns and no representation or warranty, express or implied, is made regarding future performance or the value of any investments. All recipients of this report agree to never hold Integer Advisors responsible or liable for damages or otherwise arising from any decisions made whatsoever based on information or views available, inferred or expressed in this report.

Please see also our Legal Notice, Terms of Use and Privacy Policy on www.integer-advisors.com