22 March 2018

In this first of a two-part commentary, we take a cursory look at the broader yield opportunities in the investable mortgage market in Europe. (The second part will look at similar yield opportunities across the investable corporate loan markets in Europe, dominated by CLOs). By ‘investable’ we specifically mean capital market instruments that provide near-enough an isolated exposure to mortgage loan pools, rather than bank funding-related instruments with mortgage loans as collateral. (We therefore exclude from our considerations covered bonds as well as agency-like markets such as Denmark). Historically, such capital market exposures have manifested mainly, or indeed entirely in some cases, via bonds, namely RMBS, although most deals only sell the higher rated tranches rather than the “full stack”. But in selected countries a somewhat broader suite of mortgage instrument types has emerged in the capital markets, to include whole loans and listed equities.

Our findings, as further discussed below, are that such mortgage capital market opportunities are the broadest in only the UK and Netherlands. The ten-year long pre-crisis securitisation bull market acted a as key catalyst to the growth in non-bank lending as well as autonomous origination and servicing industries in these countries. And more notably, this institutionalisation of mortgage markets survived the securitisation implosion from 2008, with the post-crisis era seeing bank asset divestments (both performing and NPL portfolios) into institutional investors initially, complemented subsequently by a newer generation of non-bank lending models. Loan assets acquired from or originated outside the otherwise dominant banking sector now forms a key part of the mortgage capital market footprint in the Netherlands and UK. Ireland also looks relatively promising with respect to mortgage capital market opportunities, though still in the early stages of lending (front-book) disintermediation.

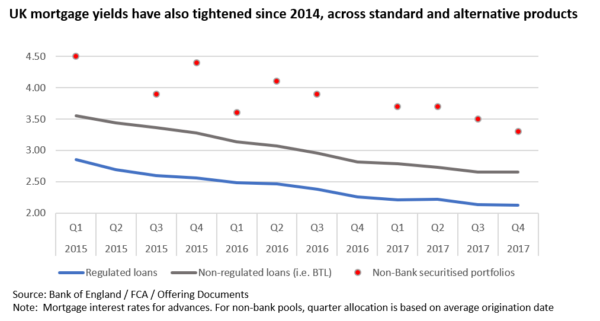

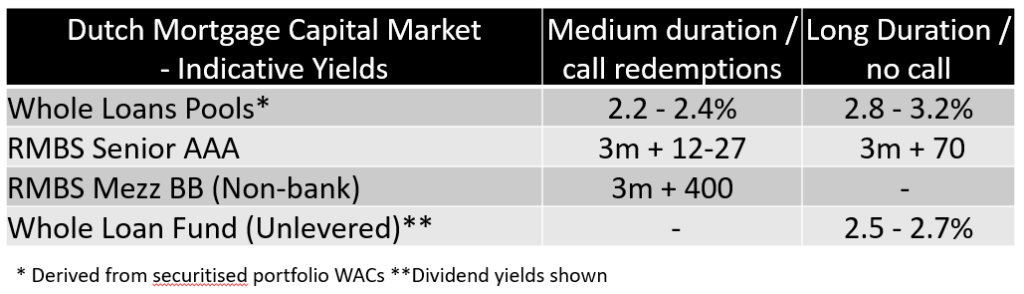

Mortgage markets like the UK, Netherlands and Ireland continue to be among the higher yielding in Europe, despite the significant yield and margin compression seen in recent years. On the mortgage instrument side, yields are particularly high in the UK (relatively speaking), which mirrors the deeper market for alternative mortgages as well as the greater use of leverage among listed products. By contrast, the Dutch mortgage market trades more defensively reflecting – in equal measure – the more conservative investor appetites and collateral types, notwithstanding continued high LTVs.

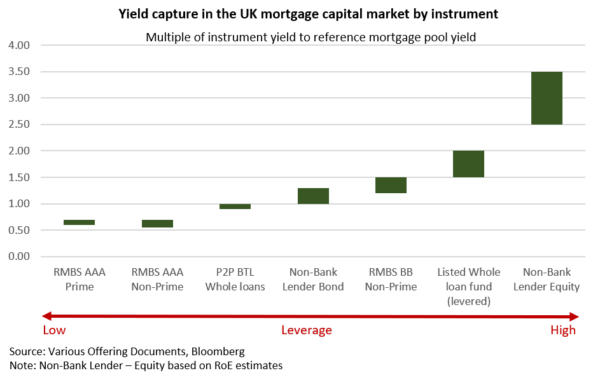

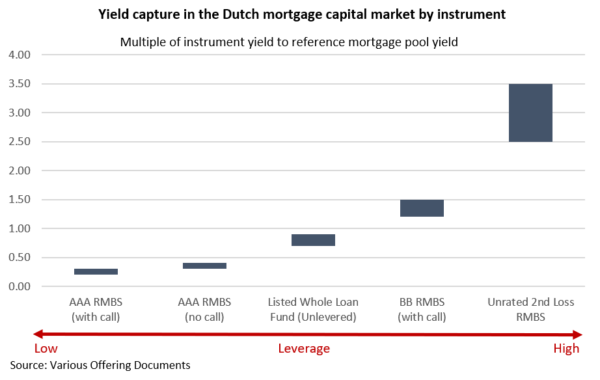

The schematic below provides a snapshot comparison of underlying mortgage portfolio yields versus liability instrument yields, expressed as multiples of the former. What is immediately observable is that the more senior or de-levered tranches of securitised mortgages trade at spreads that look entirely decoupled from underlying mortgage portfolio yields, with such spreads influenced instead by RMBS bond market technicals. By contrast, underlying asset yields are more fully realised via whole loan exposures (whether in loan or equity formats), while the more junior parts of RMBS capital structures employ leverage to extract similar or superior yields to the underlying assets.

We would caveat of course that the cross-instrument yield snapshot above paints an overly simplistic picture of relative returns. To accurately compare the risk/ return profiles across such instruments, we will need to look more forensically at the asset credit and embedded financial risks. More such analysis will follow in our future commentaries.

De-Banking: The genesis of mortgage capital markets

Going forward, we see greater institutionalisation of mortgage markets like the UK, Netherlands and Ireland as an almost inevitable evolution, underpinned by a number of factors. Key among such factors is the de-risked lending style of incumbent banks on the one hand (whether for the reason of regulatory capital constraints or otherwise), and on the other the growing appetite among institutional investors for rates or spread product surrogates that better meet their risk/ return profiles. Low capital charges and portfolio diversification benefits of residential whole loans afforded to long-dated liability managers under Solvency II will be a key catalyst in this respect, in our view.

We expect such institutionalisation to be fuelled by the continued rotation of whole loan books (both performing and NPLs) out of incumbent banks and into non-bank ownership over the foreseeable future. Irish banks remain under pressure to correct impairment ratios while in the Netherlands policy makers continue to incentivise mortgage ownership by insurers and pension funds. The recent announcement by the UK government of its plan to sell further mortgage assets including a Help-to-Buy portfolio is yet more evidence of the potential depth of the institutional investor base in residential mortgage markets. Back-book acquisitions aside, non-banks also look poised to maintain active footholds in fresh mortgage lending in countries like the UK, Netherlands and even Ireland. And as incumbent banks gradually re-intermediate some vanilla lending markets, we would expect non-bank lending to naturally creep into alternative mortgage products, which should in turn deepen the market for higher-yielding mortgages.

The degree to which the greater institutionalisation of mortgage markets seeds a greater diversity of capital market opportunities going forward depends to some extent on RMBS market technicals, in our opinion. RMBS continues to be the most economically efficient way for non-banks to fund securitisable mortgages, its limitation dictated only by the depth (or lack thereof) of the investor base. Indeed, we see the non-bank constituency continuing to dominate RMBS issuance going forward, with such issuers ranging from specialist lenders to fund manager sponsors to private equity owners of back-books, some of which will feature re-performing loans. But assuming there is no return to the pre-crisis bull market for RMBS, we would expect the scope of alternative liabilities to continue broadening as mortgage funding matures, spanning listed, ‘REIT-like’ funds and other whole loan opportunities. We would also anticipate mortgage capital markets becoming more cross-border over time in terms of investment flows, in contrast to European mortgage lending markets which are likely to remain distinctly domestic over the foreseeable future.

Looking beyond the UK, Netherlands and Ireland, we do not currently see any meaningful opportunities in other developed EU mortgage markets to take direct, uncomplicated exposures to (performing) residential loans, both from a yield or secondary liquidity perspective. Neither non-banks nor alternative lending plays any appreciable role in other countries and therefore – reflecting what are mostly bank dominated, vanilla product markets – mortgage yields remain comparably low. (As cases in point, German and French mortgage lending spreads are inside that seen in the Netherlands, adjusting for product and LTV characteristics). Mortgage capital market opportunities in these countries remain largely limited to the likes of senior-only RMBS. We do not see this market dynamic changing significantly in the foreseeable future given the very entrenched nature of banking systems and, conversely, the high barriers-to-entry for challenger or non-banks or indeed alternative lending products in the residential mortgage markets. Portfolio whole loan sales and/or ‘full-stack’ securitisations may moderately increase in frequency as the banking system complies with regulatory pressures such as leverage ratio rules, but such opportunities are likely to be limited.

Some market background

UK: The most diverse mortgage capital market in Europe, bar none

Securitisation was the key catalyst to the growth of the non-bank, specialist lender market in the UK since the 1990s (then called ‘centralised lenders’), which in tandem fuelled the growth of alternative mortgage products. Indeed, the UK stands out in Europe for having deepest market for alternative loan types, spanning self-employed, lo-doc, credit impaired, second-charge, lifetime or reverse equity mortgages and other non-mainstream product, including a uniquely defined investment, or ‘buy-to-let’, lending segment. Alternative products accounted for around 20% of all mortgage lending in recent years, with the bulk of this comprising unregulated buy-to-let loans, according to IMLA. Mortgage yields on alternative products remain appreciably higher than for standard, bank-originated loans.

While the 2008 crisis put enormous pressure on the specialist lender model, non-bank institutions found roles in the ‘secondary’ market for mortgages as buyers of legacy whole loan books, to include run-off portfolios inherited by the government. Non-bank lending disintermediation opportunities re-emerged before long, given the prolonged mortgage lending attrition and regimented risk/ underwriting appetite among the established UK banks in the post-crisis era. The newer breed of disintermediation lenders comprised not only specialist platforms, many of which are owned by private equity, but also direct lending funds and marketplace lenders, with RMBS again featuring as the funding channel for some of these asset owners/ originators. With the exception of direct lending by UK insurers which primarily target lifetime (reverse equity) mortgages, buy-to-let loans have generally dominated the asset profile of these non-bank lenders. Non-banks make up around 7% of all mortgage lending currently, up sharply from the lows reached in the immediate aftermath of the crisis, but down from the peak of 18% reached in 2007. (Source: IMLA)

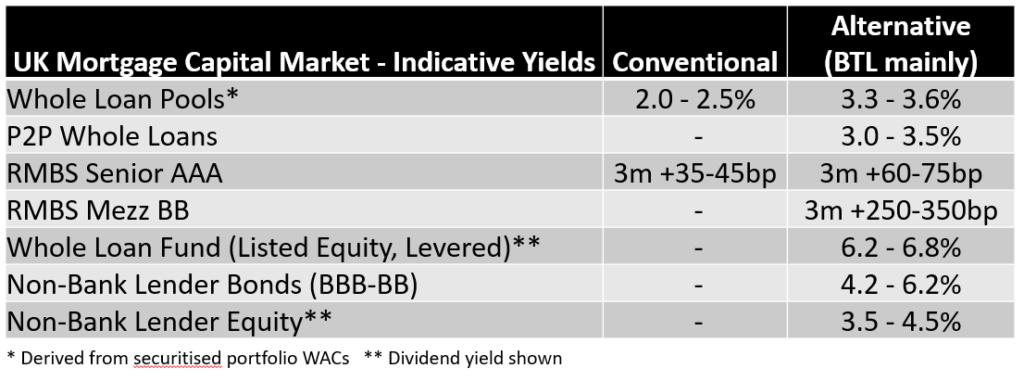

Reflecting what is both the most diverse mortgage owner/ lender constituency and the deepest lending market for alternative mortgage product in Europe, the UK remains distinguishable today for its broad suite of investable mortgage instruments. These comprise not only RMBS but also listed funds from UK asset managers investing in mortgages (or, more precisely, funding intermediary specialist origination platforms), marketplace loan opportunities and even vanilla bonds/ equity issued by ‘narrow’ or monoline mortgage challengers. The table below captures the yield continuum by instrument/ lender-type across the mortgage credit spectrum in the UK, with the alternative segment dominated by buy-to-let product mostly.

As is clearly observable, mortgages continue to offer compelling yield opportunities as a credit asset class on a relative basis. We would caveat again that there is of course a trade-off between enhanced mortgage yields and risks, which in the UK is inherent in loan credit quality and/ or financial leverage, employed in RMBS as well as listed whole loan funds. Balance sheet liabilities of monoline mortgage lenders should also be analysed in the context of potential structural subordination and corporate event (non-asset) risks.

Netherlands: Champion of the whole loan model, but yield opportunities for the few only

The Dutch story is slightly different. Non-bank lending is an established practice in the Netherlands, with insurers and pension funds in particular long being a relatively dominant lender constituency, alongside the banks. Securitisation funding has historically been used by banks and non-banks alike. The Dutch RMBS market was arguably the most resilient coming out of the 2008 crisis (measured by the recovery in primary RMBS volumes, not least), with the crisis disruption limited by the relatively small component of alternative product and/or ‘originate-to-distribute’ specialist lenders.

However, the prolonged housing recession coupled with high profile bank lender failures during the post-crisis era, led to a distinct shift in the wholesale sources of mortgage lending. Insurers and pension funds became noticeably more active in the lending market, with the full endorsement of policy makers championing a better balance of lender types and asset-liability matching in addressing the funding gap within the system. Such long-dated liability managers were also buyers of whole loan pools divested by incumbent banks. This shift in mortgage market ownership was complemented by new non-bank specialist lender platforms. On most measures, the mortgage market in the Netherlands is the most institutionalised in Europe currently, with banks and non-banks sharing almost equal shares in new mortgage originations. (According to consultancy IG&H, approximately 40-45% of all front-book lending in the Netherlands currently is from non-banks such as insurers, pension funds and specialist lenders; the equivalent share was around 20% in 2008). Notably also, non-bank lenders in the Netherlands are much more dominant in the mainstream mortgage market, unlike say the UK or Ireland where non-banks tend to operate in more niche or underserved lending segments.

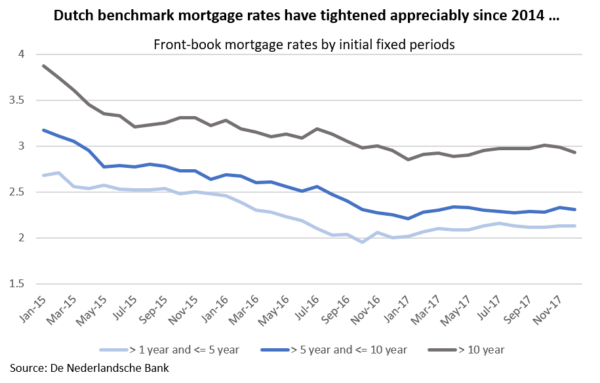

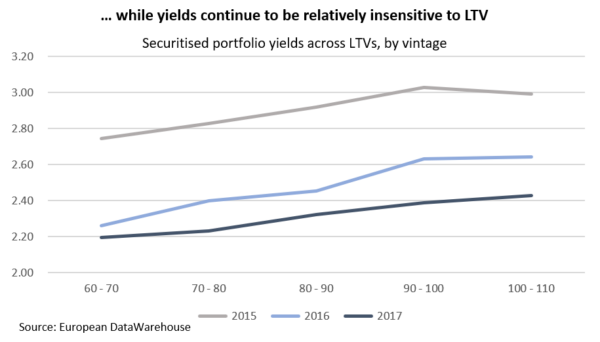

We infer from the relatively narrow asset yield range that the dispersion of credit quality is equally narrow (unlike the UK), meaning that the Dutch mortgage loan market is comparably homogenous. Non-prime lending did have some presence in the pre-crisis period (Lehman’s ESAIL and GMAC-RFC’s E-MAC platforms being the most well-known in this respect), but to our understanding such lending has all but ceased since the financial crisis. Where there are outlying high asset yields among Dutch mortgages, these are typically explained by longer-than-normal fixed rate reset periods of up to 30 years (see chart above). High LTV loans also incrementally influence yields, but the ‘delta’ in this regard is fractional compared to other markets in which high LTV loans are normally labelled as ‘alternative’ (see chart below). High LTV loans have always been and still are very mainstream in the Dutch mortgage market, a legacy of generous interest tax deductibility.

The capital market footprint of Dutch mortgages continues to be dominated by RMBS (private whole loan sales aside), however as mentioned above there has been a notable growth in institutional asset managers primarily (or exclusively) originating mortgages for pension funds, with a select number of these funds being listed. Dutch mortgage capital market instruments currently trade in a relatively tight yield range (save for deeply subordinated RMBS), commensurate with asset yield behaviour. As a case in point, listed mortgage funds in the Netherlands – albeit still rare as an opportunity type – offer yields that mimic the underlying asset market minus servicing (25-30bp) and fund administration (20-25bp) costs, in contrast to the UK where leverage tends to be more readily employed to enhance offered yields. We think the predominance of unlevered mortgage funds in the Netherlands reflects the capital constraints of investing in geared mortgage instruments under Solvency II, the relevant rule-book for the largest segment of domestic institutional investors.

Dutch mortgage yields have also compressed significantly in the past few years which makes the current market look rich on a historical context. No doubt the relatively low, range-bound yields are arguably justified by the credit homogeneity of mortgage assets, however to us the Dutch mortgage capital market seems better catered currently to defensive investors, most of which comprise the domestic insurers and pension funds. Duration-rich mortgages in the Netherlands are naturally suited to such long-dated liability managers.

Ireland: Compelling (hypothetical) returns but capital market remains in its infancy

Mortgage yields in Ireland are among the highest in Eurozone, meriting a mention in our view. Headline benchmark rates are some 1.5% higher than in core Europe, while recent securitised portfolio data indicate that performing non-bank front-book yields are in the range of ca.4%.

We would first remark that the non- and sub-performing component of the broader Irish property finance market is substantially owned by institutional investors (mostly private equity firms), following the exceptional scale of de-leveraging undertaken by Irish banks and NAMA in the crisis aftermath. However institutional ownership of large swathes of non- and sub-performing legacy financing assets has yet to meaningfully translate into institutional non-bank residential mortgage lending. Save for some buy-to-let refinancing activity, lending disintermediation by non-banks in the mortgage market has been tepid thus far, defying the yield opportunities on offer. (Non-banks accounted for less than 2% of new lending in 2016, according to the CCPC report). Likely reasons for this include, we believe, the combination of tighter post-crisis lending regulations and still relatively weak demand for financing, not to mention the limitations of scale in a country like Ireland. New mortgage lending in Ireland is currently running at around 10-15% of volumes seen in 2007, the sharpest correction of any market in Europe, according to the EMF.

Ireland has for now a very small mortgage capital market, limited to the few RMBS opportunities. Such opportunities have notably included deals from non-bank issuers as well as NPL/ re-performing portfolio securitisations. As non-banks increase their dominance in alternative mortgage markets (buy-to-let or otherwise), we expect to see a deeper market for RMBS emerge as a precedent, potentially, to other liability types in the mortgage capital market. This development does not appear imminent, however.

Disclaimer:

The information in this report is directed only at, and made available only to, persons who are deemed eligible counterparties, and/or professional or qualified institutional investors as defined by financial regulators including the Financial Conduct Authority. The material herein is not intended or suitable for retail clients. The information and opinions contained in this report is to be used solely for informational purposes only, and should not be regarded as an offer, or a solicitation of an offer to buy or sell a security, financial instrument or service discussed herein. Integer Advisors LLP provides regulated investment advice and arranges or brings about deals in investments and makes arrangements with a view to transactions in investments and as such is authorised by the Financial Conduct Authority (the FCA) to carry out regulated activity under the Financial Services and Markets Act 2000 (FSMA) as set out in in the Financial Services and Markets Act 2000 (Regulated Activities Order) 2001 (RAO). This report is not intended to be nor should the contents be construed as a financial promotion giving rise to an inducement to engage in investment activity.Integer Advisors are not acting as a fiduciary or an adviser and neither we nor any of our data providers or affiliates make any warranties, expressed or implied, as to the accuracy, adequacy, quality or fitness of the information or data for a particular purpose or use. Past performance is not a guide to future performance or returns and no representation or warranty, express or implied, is made regarding future performance or the value of any investments. All recipients of this report agree to never hold Integer Advisors responsible or liable for damages or otherwise arising from any decisions made whatsoever based on information or views available, inferred or expressed in this report. Please see also our Legal Notice, Terms of Use and Privacy Policy on www.integer-advisors.com